Intelligence (AI) refers to machines that are capable of performing tasks that normally require human intelligence1; by mimicking human cognitive processes such as learning, thinking, judging, predicting, inferring, reasoning and initiating actions. The concept of AI was first introduced in 1956 by Professor John McCarthy, an American computer scientist, pioneer and inventor; during the first AI conference at Dartmouth. The concept was finally realized in the late 1990s, and since then, this intelligent technology has grown to include natural language processing, image recognition, deep learning, speech recognition and emotion recognition. Its role became particularly critical after 2011 when tech giants, the likes of Amazon, Google, Facebook and Apple; started showing signs of great interest, adoption and heavy investments in research and development in this space (Kmeid, 2017).

The pace of innovations in AI and blockchain applications has accelerated in recent years with the explosion of data, leading to a massive increase in data and computing power. Capable of problem-solving and decision-making, AI has enabled computers to undertake more and more human tasks with facial recognition, analyze social media messages, listen and speak, and gauge emotions (Abdullah, 2017). Given the continuing evolution in AI, its market is expected to grow at a rate of 62.9% CAGR to be worth US$16.06 billion by 2022 (Research and Markets, 2017). The market for big data technology and services, on the other hand, is estimated to reach US$48.6 billion by 2019 (Rahim, Mohammad, & Abu Bakar, 2018).

How AI and Blockchain is Transforming the Finance Industry

AI is disrupting diverse industries, but the financial services industry has been through the greatest transformation and is currently at the forefront in both investment and adoption of AI technology. Over the past decade, people’s attitude towards traditional banking has changed dramatically and customer expectations are even higher than they ever were. The evolution of technology and increased customer expectations combined with the emergence of disruptive competitors, is placing significant pressure on the banking industry to implement new strategies to remain relevant in the future. Hence, the need for banks to embrace new intelligent technologies is imminent to compete in a highly digitised world (Kmeid, 2017).

AI offers three main applications in the financial services industry — cognitive automation, cognitive engagement and cognitive insight (Abdullah, 2017). Cognitive automation is a knowledge-based technology that is applied to automating specific business processes and as such is commonly associated with Robotic Process Automation (RPA). RPA uses a number of techniques to replicate routine human activities automatically, repeatedly and more accurately. Within the finance industry, RPA is being used to minimize the manual processing of voluminous data and minimize human errors. In fact, RPA can reduce the need for repetitive manual work tasks, data reconciliation, and transcription up to 70%. In terms of its applications, RPA is now being used to reduce loan processing time by eliminating the copying-and-pasting of customer information from one banking system to the next; boost the speed of customer verification and validation; and automate manual processes for inspecting suspicious transactions reported by anti-money laundering systems. Some of the banks that have implemented RPA to automate business processes are Deutsche Bank, BNY Mellon, Sumitomo Mitsui Financial Group Inc., Mitsubishi UFJ Financial Group Inc. (MUFG), and Mizuho Financial Group Inc.

Cognitive engagement, on the other hand, refers to the cognitive agents that use cognitive technology to interact with users, understand data received and conduct actions on behalf of the users. An example is ‘chatbot’, which is a software programme that uses interactive messaging as an interface through which banks can help their customers answer questions, find information and offer personalization. The functions covered by chatbots are mainly customer services, transactions and product sale. An increasing number of financial institutions are leveraging AI to launch chatbot solutions to facilitate two-way communication, and thus, replacing channels such as phone, email or text. The objective is to provide quick service and transactional support on many basic tasks such as balance inquiry, bank account details and loan queries.

Bank of America and American Express, for example, are using chatbots to provide customer service through voice and text messages whilst Wells Fargo introduced an AI-driven chatbot through Facebook Messenger. HSBC (Hong Kong) developed a virtual assistant chatbot named ‘Amy’, which is a customer servicing platform that provide instant support to customers’ inquiries on a 24/7 basis. Commonwealth Bank (Australia) launched a chatbot called ‘Ceba’ to assist customers with over 200 banking tasks such as activating their card, checking account balance, making payments, or getting cardless cash.

Finally, cognitive insights use algorithms to detect key patterns in vast volumes of data and from multiple sources, and interpret the meaning. Examples of cognitive insights include the intelligent credit scoring algorithms being implemented in multiple banks across the globe, algorithm trading, fraud detection and customer recommendations. Applications based on cognitive insights are used by banks to better understand the way customers process information and make decisions; generate dynamic segments based on client behaviour, apply industry-specific models to deliver actionable insights, predict future financial events of clients, and drive personalized client offers.

AI has the potential to address financial inclusion issues. Microfinance institutions (MFIs) face difficulties in expanding due to the lack of relevant data and intelligent algorithms, in effect, limiting the availability of credit to the masses. Love For Data (LFD) provides a solution to this problem by designing “SECURELend” – an AI-based credit scoring portal which would allow MFIs to calculate credit risks, fraud risks, and verify if the applicant exists on various watch lists. Hence, LFD enables MFIs to give out safer loans, with lower chances of default and fraud. It has successfully implemented the credit scoring solution with an overall accuracy of 85% in predicting default.

Blockchain was first introduced as the core technology behind bitcoin in 2008. This technology has now fast evolved into mainstream applications far beyond its initial purpose. As a form of distributed ledger technology (DLT), blockchain has the potential to transform the financial services industry by reducing costs, speeding up transactions, improving transparency, and offering added security. Blockchain can also be used as a digital identity tool, eliminating the need for cumbersome paper documents that can easily be lost or forged. The transformative potential of blockchain is based on the fact that the traditional financial system is based on a middleman, such as a bank, to confirm a transaction (Bhattacharyya, 2017). Hence, with blockchain we would expect to experience greater autonomous transactions in financial services where participants can transfer value across the internet without the need for a central third party whilst buyers and sellers can interact directly without needing verification by a trusted third-party intermediary. Within finance, blockchain is already being used in several areas including clearing and settlement, trade finance, cross-border payments, insurance, anti money laundering (AML) and know-your-customer (KYC).

By replacing older statistical modelling approaches with AI and cognitive computing technology, financial institutions may experience dramatic cost cuts, improved operational efficiency and enhanced overall profitability. AI can solve as well as anticipate complex financial problems. The suite of tools available in AI can bring a whole new experience to the world of finance. Using a powerful set of tools, powered machine learning, natural language processing and deep neural networks; developments in AI are such that enabled devices can solve as well as anticipate complicated financial issues (Tham et al., 2017; Todorof, 2018). In this way, AI can aid regulatory compliance, which often carries significant cost and liability.

Intersection of AI and Islamic Finance

When it comes to intelligent technology, what applies to conventional finance also applies to Islamic finance. As customers become more sophisticated and knowledgeable, AI becomes extremely critical to Islamic finance. Just like in other aspects of life, the smart use of AI will be a game-changer for the Islamic finance industry. Today’s customers of Islamic financial institutions require greater transparency, personalized products and seamless experience across all channels. Disruptive AI challenges the old models and provides them with greater choice, convenience and reach. It can make proactive recommendations to customers and suggests courses of action based on data, logic and specific circumstances; which helps to elevate the customer experience. AI is able to influence the speed and accuracy of this experience too. It is estimated that by 2020, customers of financial institutions will conduct 85% of their financial transactions with no human interaction (Kmeid, 2017).

For Islamic financial institutions, the benefits of adopting AI and blockchain are staggering — costs reduction, enhance accessibility, increase efficiency, streamline labour-intensive tasks, and gain competitive advantage. However, the development and use of AI and blockchain in the Islamic finance industry is in its initial stage. The adoption of AI in Islamic financial institutions has become a mandatory option as customers’ needs rapidly arise in a way that methods traditionally employed by banks will not suffice to meet them. Given tech-savvy millennials strong preference for digital tools and interfaces, the adoption of next-generation technologies is no longer a choice, but an absolute imperative for Islamic financial institutions to grow in the current competitive environment and achieve economies of scale and scope.

In a way, these changes in the pattern of behavior among customers are forcing Islamic financial institutions to quickly rethink ways to meet the evolving needs of their customers. As such these developments provide opportunities for innovation, growth and boosting performance. However, the digitization efforts in Islamic finance need to catch fast as the industry is still lagging behind in adopting deep and transformative digitization strategies compared to its conventional peers.

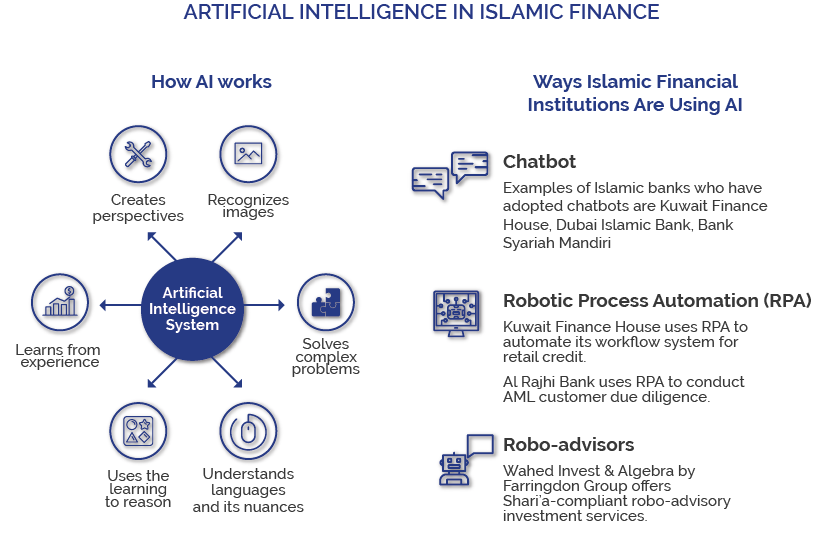

Ways Islamic Financial Institutions are Using AI in Their Operations

Islamic financial institutions have been fertile grounds for innovations due to the absence of legacy infrastructure. While imitating their conventional counterparts and coping with competition, AI brings newer opportunities. Accordingly, Islamic financial institutions can provide a suite of personalized AI-driven banking services that will suit the needs and values of their customers. In this regard, digitization of operations is foremost among the ways Islamic financial institutions employ AI; including the use of data-based AI applications, blockchain for smart contracts, digital and/or mobile wallets, voice assistants and personalized customer support among others (ProSchool, 2018).

Islamic financial institutions are looking for ways to deploy chatbots to handle day-to-day banking tasks in the appearance of 24/7 customer services activities (Deutsche Bank, 2018). From the customer perspective, it is apparent that they benefit from AI technology in terms of reduced waiting time in customer service or real-time turnaround for banking and wealth management services, among others. A number of Islamic banks have integrated chatbots into their customer service infrastructure. Bank Syariah Mandiri in Indonesia launched its Mandiri Syariah Interactive Assistant or chatbot named Aisyah. In a move to drive its digital transformation by improving customer engagement, Kuwait Finance House launched its chatbot under the name Baitak Assistant. Other banks in the Middle East whom have adopted chatbots are Boubyan Bank, Emirates Islamic and Dubai Islamic Bank. Albaraka Turk employed AI-powered bots for its human resources management named Rubicio. According to the bank, with the help of the Rubicio, they are able to reduce the number of incoming calls by 65% and increase productivity of employees.

In Malaysia, for instance, some Islamic banks have adopted the use of AI particularly in the customer care operations. Hong Leong Bank’s AI chat service took a first step towards introducing a new channel for customer interaction via the live chat function, which is available on the Hong Leong Bank Corporate Website. Another bank is CIMB bank, which seeks to assist customers via a mobile application called CIMB EVA to manage users’ daily banking needs. With CIMB EVA, customers can easily check their account balances, pay bills and reload prepaid phones. In the same vein, there is OCBC Bank, Maybank, and Bank Muamalat Malaysia Berhad among others.

for the current bank’s policy and national regulations. This is expected to result in substantial cost reductions, stemming from error reductions and increase in compliance. RPA can also be used to analyze fraud operations and solve issues facing customers on daily basis such as blocking transactions or blocking ATM cards for operations abroad. In a more innovative fashion, Al Rajhi Bank uses AI to conduct AML customer due diligence as well as transactions monitoring (Rosli, 2017). According to Al Rajhi Bank, the adoption of RPA has reduced potential fraud cases for ATM cards and credit cards by 70%.

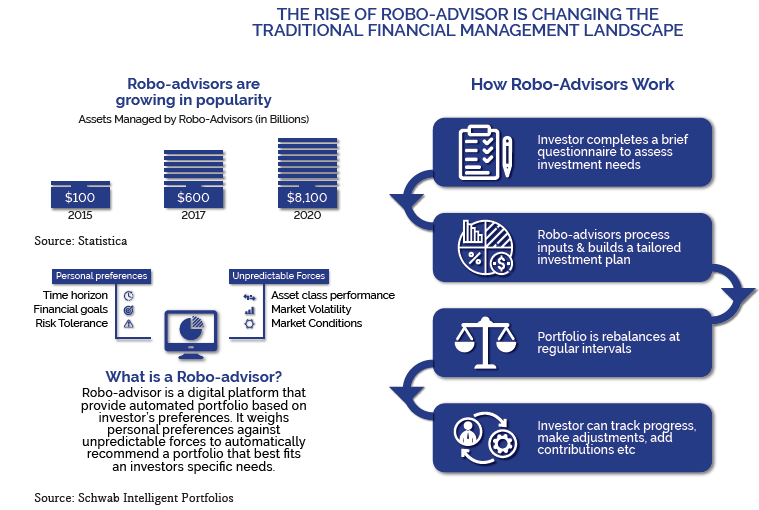

Another interesting application of AI is in the advancement of robo-advice capabilities. With AI coming into play, Robo-powered advisory services are becoming more cognitive-enabled, replicating human skills and emotional intelligence. Robo-advisors are basically online financial advisory platforms that use technology to provide automated, algorithm-based portfolio management advice. As such Robo-advisor platforms eliminate the need to utilize a human financial advisor and thus, provide customers with direct, 100% software-based access to their portfolios. In order to cater for the growing affluent of Muslims, Wahed Invest (an Islamic finance Robo-advisory firm based in the US) offers a Shari’a-compliant Robo-advisory investment services; allowing savers from all income brackets to invest in a globally diversified portfolio of ethically responsible stocks, sukuk and gold for as little as US$100.

Another robot-advisor platform that offers Shari’a-compliant investments is Algebra, which was launched by Malaysia-based Farringdon Group in July 2017. Although Algebra offers mainly Shari’a-compliant investments, the platform’s users also have the option of investing in the conventional space. The scope of Shari’a Robo-advisors is presently limited to Shari’a-compliant investment and wealth management. Their roles can be extended beyond just merely financial advice and wealth management. For example, the AI bots can be used to validate basic requirements of Shari’a-compliance for products or contracts, including checking if they meet specific maqasid Shari’a or even ESG (Environmental-Social-Governance) criteria (Sultan, 2017).

Islamic banks are typically smaller than their conventional rivals. With the industry’s high fixed costs, this has put them at a disadvantage due to their relative lack of scale. AI innovations can help reduce this gap and provide Islamic banks with a competitive level playing field by lowering their administrative costs and enhancing security. By investing in RPA, for example, Islamic financial institutions are better able to optimize operational efficiency and enhance business quality. In early 2019, Kuwait Finance House implemented a RPA platform that automates its workflow system for retail credit. The RPA bot handles customer applications and autonomously create credit reports based on the customer’s eligibility status, accounting for the current bank’s policy and national regulations. This is expected to result in substantial cost reductions, stemming from error reductions and increase in compliance. RPA can also be used to analyze fraud operations and solve issues facing customers on daily basis such as blocking transactions or blocking ATM cards for operations abroad. In a more innovative fashion, Al Rajhi Bank uses AI to conduct AML customer due diligence as well as transactions monitoring (Rosli, 2017). According to Al Rajhi Bank, the adoption of RPA has reduced potential fraud cases for ATM cards and credit cards by 70%.

Another interesting application of AI is in the advancement of robo-advice capabilities. With AI coming into play, Robo-powered advisory services are becoming more cognitive-enabled, replicating human skills and emotional intelligence. Robo-advisors are basically online financial advisory platforms that use technology to provide automated, algorithm-based portfolio management advice. As such Robo-advisor platforms eliminate the need to utilise a human financial advisor and thus, provide customers with direct, 100% software-based access to their portfolios. In order to cater for the growing affluent of Muslims, Wahed Invest (an Islamic finance Robo-advisory firm based in the US) offers a Shari’a-compliant Robo-advisory investment services; allowing savers from all income brackets to invest in a globally diversified portfolio of ethically responsible stocks, sukuk and gold for as little as US$100.

Another robot-advisor platform that offers Shari’a-compliant investments is Algebra, which was launched by Malaysia-based Farringdon Group in July 2017. Although Algebra offers mainly Shari’a-compliant investments, the platform’s users also have the option of investing in the conventional space. The scope of Shari’a Robo-advisors is presently limited to Shari’a-compliant investment and wealth management. Their roles can be extended beyond just merely financial advice and wealth management. For example, the AI bots can be used to validate basic requirements of Shari’a-compliance for products or contracts, including checking if they meet specific maqasid Shari’a or even ESG (Environmental-Social-Governance) criteria (Sultan, 2017).

The deployment of AI in the Islamic banking industry, as it is generally envisaged, brings about a strengthened working system by delivering a banking process that is seamless and trouble-free. This is needed as much as the sustainability of the Islamic banking system itself. In this respect, the crux of the matter is making AI-based innovations to be Shari’a-compliant. As a matter of RegTech nonetheless, AI has the potential to be employed by regulators to track and identify violations of any Shari’a rules and/or any relevant financial regulations. This will assist regulators in timely anticipation of the impact of new regulation or change to extant ones (Wall, 2018).

The race for AI-driven innovations is true in private spheres as much as in the public sector. As a public-level initiative, several jurisdictions have taken decisive steps and officially launched AI for public expenditures and transactions. Accordingly, governments are also involved in the technology race with respect to AI. For instance, in October 2017, the government of the United Arab Emirates (UAE) launched the UAE 2031 Strategy for AI, which is the first of its kind in the region and the world (The Official Portal of the UAE Government, 2018). The aim of the strategy is to make the UAE the first in the world in the field of AI investment in various vital sectors, as well as create a new vital market with high economic value (UAE Government, 2017). The strategy is expected to create a highly productive innovative environment by investing in advanced technologies and AI tools that will be implemented in all fields of work. When fully implemented, the UAE government expects to save US$2.9 billion in economic return and US$105.9 million in government documents alone per year.

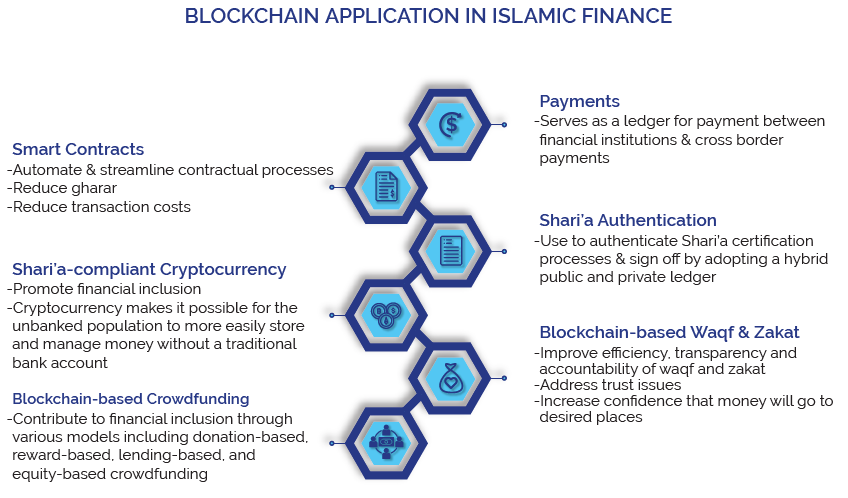

Integrating Blockchain into Islamic Finance

An increasingly number of Islamic financial institutions are using blockchain technology for complex financing contracts and Shari’a-compliant transactions, as well as to drive innovation and improve transparency and traceability of financial transactions. An early adopter of blockchain technology in Islamic finance is Al Rajhi Bank. The bank executed its first transaction between its Jordanian unit and its Saudi head office using blockchain technology in 2017. Since then, Al Rajhi has used blockchain technology to complete cross-border transfers outside of its network as well as the Middle East region. Emirates Islamic, on the other hand, has integrated blockchain technology into its cheque-based payment processes to strengthen their authenticity and minimize the potential for fraud. Emirates Islamic’s security enhancement feature, called Cheque Chain, involves the bank issuing new chequebooks carrying a unique quick response (QR) code on every leaf along with 20 random characters. Each cheque is then registered on the bank’s blockchain, enabling it to validate a cheque’s authenticity at source.

Another application of blockchain is the smart contract, which is a computer programme that automatically enables, executes and enforces contracts. Since the terms of the contract are electronically coded, they will only be executed only if the underlying conditions are met. This automates the entire contractual process for Islamic financial institutions, alleviating the additional administrative and legal complexities and redundancies (Ikram, 2018). Besides making Shari’a-compliant contracts much simpler and cheaper, smart contracts have the added benefit of eliminating a lot of redundancies associated with Shari’a-compliant financial products and subsequently reduce any element of gharar (uncertainty). In this space, Al Hilal Bank successfully executed the first sukuk transaction on a blockchain in 2018. Leveraging smart contracts protocol to digitalise the sukuk market will improve transactional efficiencies while reducing the high overhead costs associated with issuing and settling sukuk. Blossom Finance launched the digital sukuk in late 2018. Using the Ethereum blockchain, retail investors will be able to invest in the sukuk, which will then use the proceeds to fund Shari’a-compliant microfinance initiatives in Indonesia. Using a profit and risk-sharing model, Blossom Finance aims to provide an annual return of about 9% to investors.

The institutions of waqf and zakat are prime candidates for blockchain disruption. Both of these institutions are plagued with inefficiency and lack of transparency in terms of how the funds are collected, managed, distributed; and subsequently resulting in trusts issues. Blockchain technology can address these problems. The adoption of blockchain will improve the efficiency, transparency and accountability of waqf and zakat, and thus increasing confidence that money will go to the desired places. This in turn will greatly increase contributions. Recently, Finterra launched a blockchain-based solution to crowdfund waqf. The Waqf Chain platform not only allows the public to participate in waqf, but also allows them to trace their participation and transactions within the chain. This makes the process more transparent and efficient. The platform also allows waqf boards, non-governmental organizations, trusts and other stakeholders to submit project outlines and plans for waqf projects and developments.

In recent years, cryptocurrency, the most well-known creation of the blockchain, has become mainstream. The first Shari’a-compliant cryptocurrencies emerged in the form of gold-dominated cryptocurrencies launched by Dubai’s OneGram and Malaysia’s HelloGold. Emergent Technology (EmTech), recently announced that its blockchain-based gold supply chain ecosystem has received Shari’a-compliance certification. In addition to gold-backed crypto firms, general blockchain infrastructure startups have started to receive Shari’a certification. Stellar, a US-based open-source platform for distributed payments, is reportedly the first distributed ledger protocol to obtain Shari’a-compliance certification in the money transfer and asset tokenisation field.

AI, Blockchain and Financial Inclusion in Islamic Finance

Islamic finance has taken great strides this century, with Shari’a-compliant financial assets expected to reach US$3 trillion by 2020 (GIFR, 2018). Yet financial inclusion in the Organization of Islamic Cooperation (OIC) member states lags global norms. Less than 30% of households in the OIC countries have an account at a financial institution (IMF, 2015). Furthermore, high transaction costs make it uneconomical for Islamic banks to offer fully-fledged bank accounts to low-income groups, which make up a large part of the population in most developing countries. Islamic financial institutions are also generally inferior in terms of their distribution network and human resources.

Two emerging technologies with the potential to create enormous opportunities around data and how it can be leveraged to deepen financial inclusion in the longer-term are AI and blockchain. As an important pillar for a sustainable economy, financial inclusion is an enabler of economic development and AI and blockchain help attain that in several ways. Using the peculiar risk-sharing contracts, such as musharaka and mudaraba, which are inherent in Islamic banking, accompanied with redistributive facilities including qard hasan, sadaqah, waqf and zakat; Islamic banks can facilitate access to finance and promote inclusion. By incorporating these facilities in modern financial services channels, Islamic banks promote financial inclusion via mobile banking, digital and mobile wallet etc (Naceur et al., 2015).

Yet access to credit is not the only element of financial inclusion that is central to consumers’ financial well-being. Other facets of financial access, such as effective savings products and retirement assets, are arguably more important than credit creation alone. AI-enabled products are making inroads in these market segments as well. The kind of financial inclusion envisaged by Fintech, blockchain and AI involves more than just inclusion into the banking and/or financing system. They cover convenient access to and effective usage of financial services by all citizens as well as enhanced quality of such services. Hence, AI and blockchain are perfect mediums to incorporate and operationalise Islamic values of justice, equality, trust and fairness into finance, which embodies the spirit of the Shari’a (Zainuddin, 2017).

Blockchain-based crowdfunding has a huge potential to be a viable platform to promote financial inclusion by making financial services more accessible to all. Integrating blockchain technology to crowdfunding would elevate crowdfunding to another level. It would not only enhance data security but also offers efficiency and affordability. Shari’a principles, on the other hand, provide guidelines to build and develop socially responsible blockchain-based crowdfunding (Muneeza et al., 2018). Hence, blockchain-enabled Islamic crowdfunding platforms could benefit society as a whole.

Shari’a-compliant lenders can capitalize on high mobile phone penetration across the Muslim world to attract new customers through digital channels, with the requirements to open a digital wallet, which typically allows for money transfers, microcredit and bill and goods payments. Where once a long-standing bank account and a regular salary were prerequisites to borrow, Islamic banks can now assess a person’s creditworthiness by analyzing spending patterns on their digital wallets. This allows Islamic banks to lend small amounts to lower-income groups, increasing financial inclusion, while initiatives such as crowdfunding enable retail customers to invest in sukuk and other Shari’a-compliant instruments that deliver better returns than savings accounts. Phone-based biometric identity applications – via the likes of eye scans, fingerprints and voice or facial recognition – can provide a digital identity for unbanked and undocumented people. Embedded in the blockchain, this digital identity can include immutable birth, education and health records, as well as voter registration and property titles; bringing holders into the financial system.

Challenges to the Use of AI in Islamic Banking

AI appears to be capable of virtually replacing human in almost every workplace with ‘intelligent machines’. These machines are deployed in banking operations and form the bedrock of financial technology. However, the algorithms behind financial technology are not fool-proof against certain bias that will be difficult to anticipate and/or detect. A biased outcome often arises in an AI-driven interaction when data that reflects existing biases is used as input for an algorithm, which then incorporates and perpetuates those biases in the operation of a device (Petrasic & Saul, 2017). On this note, the financial institution concerned is responsible for the omission or commission occasioned by such bias even though the supposed bias is apparently accidental. While the race for AI is being run in the banking industry, with the prospect to be made applicable in many banking services, the question on the degree of intelligence of such machines to solve the complex human problem seems genuine. Likewise, the question of AI in regulatory technology vis-à-vis financial technology deserves a space amongst other reservations (Arnold, 2016). Of more interesting concern here is the use and application of AI in Islamic financial services.

Due to the unique nature of Islamic banking, the use of AI to conduct Islamic finance transactions deserves unique consideration. These are the considerations for both the role of the divine as well as human values, which Islamic finance is out to uphold in financial dealings. It is a challenge with regards to the quality of considerations when it comes to certain roles of values such as piety, what is prohibited (haram) and what is allowed (halal) in Islamic banking (Ali, 2011). Besides these issues, experts express reservation that as machine learning assumes a more powerful and pervasive state, its complexity, as well as the potential of harm to human, might also increases (Petrasic & Saul, 2017). Nonetheless, the banks, pressured by the anxiety not to fall behind in the race for technology, are doing all they could to adopt AI-based technologies and at all cost.

finding the right method of regulation. This is challenging because extant financial regulations does not contemplate AI when they were enacted. Even though AI can now perform tasks that humans cannot, AI applications are not human. Hence, different genre of regulation is required to be developed. In essence, applying rules meant for human interactions to regulate AI, in the same way, would stifle the development of new AI-driven financial products and/or solutions and restrict the employment of AI by banks. Therefore, finding the right method of regulation is not easy. Another challenge lies in the fact that AI is a technology that needs to be regulated like any other. Suitable data protection and privacy laws are required in the context of AI-driven relationships. The need to have ethical code for AI has also been viewed by professionals as a fundamental requirement (Abdullah, 2018).

With regards to the issue of privacy and ethics, a common framework that is internationally recognized as an ethical and legal yardstick for the designing, production, usage and governance of AI needs be evolved. Since it is technology that uses the internet and in some respects the blockchain which is global; such a framework needs to be global in the first place. Moreover, with Shari’a concerns addressed via appropriate RegTech, AI techniques have the capability to transform the Islamic finance industry as it is known today with several advantages. It is worthwhile to note that the emergence of the AI technology, in general, is the outcome of researches into the field of human learning, language as well as sensory acuity. Such researches are required to address Shari’a issues as well as other challenges in RegTech that will cater for certain concerns on divine Islamic values with a view to ensure Shari’a compliance of AI-driven Islamic banking transactions in multiple channels.

Development of AI is becoming rapid and its use in banking has the potential to transform the entire banking industry as well as other sectors in an economy. AI will have significant implications, depending on the extent to which that potential is realized, for conducting financial operations by banks and for prudential supervision. Therefore, while embracing automation through the use of AI in Islamic banking and finance, the institutions need to be mindful of the fact that it comes with certain concerns. Foremost is the social impact of displacement in a job because for each service delivery channel over which AI is employed, one or two workers or persons might be displaced. This is in addition to the cost of acquisition of the technology. Another concern is related to cybersecurity issues since technologies cannot be guaranteed as infallible either on their own or due to human or other interferences.

However, the availability of data on Islamic banking and all its uniqueness imposes limitations to the deployment of AI. As it is empirically acknowledged, limited data restricts statistics and this by implication includes machine learning, which can be used in facilitating the writing of regulations specific for Islamic banking in AI-driven operations. Thus, AI is of limited help on matters without the necessary data. Regrettably, it is observed that most of the issues relevant to financial regulations are related to the problem of data limitation (Wall, 2016).

Conclusion and Recommendations

Using AI offers reduced operational costs as well as minimal chances of error, provides multi-tasking platforms and with longer working hours for the banking institutions. As evidenced by its fast development as well as employment in several segments of the real economy such as agriculture, AI has carved itself a niche in the financial services industry, locally and globally. The use of AI-powered chatbots are radically changing the face of the banking industry. However, the question that remains to be answered is whether these chatbots are convenient and useful enough to replace human intervention? This question is relevant because a chatbot is said to have its own limitations, as such human intervention is still necessary. As “virtual assistants”, chatbots can only answer when a question is asked or a query is made in the manner it is programmed to answer. According to experts, currently, most chatbots used in the banking industry work using a rule-based technology and they are programmed to respond to thousands of hardwired rules. As such, any query outside those rules, or asked in a manner that does not fit into those rules, will elicit a generic response like “OK” or “Is that so?” or something completely nonsensical from a human perspective (Hossain, 2018). Therefore, though chatbots are useful for the banking industry, it would not be wrong to state that right now since they are developed using rule-based technology, they are not yet intelligent enough to replace human intervention completely.

Notwithstanding, AI has come to stay in Islamic banking and finance and will be developed to be employed in several of its transactions that are not covered today. AI is the brain behind Fintech and thus, the accompanying gains of easy access to formal financial services that facilitate financial inclusion among others will be possible only through AI. Certain challenges that militate against finding the right method of regulating AI can be overcome by refining existing rules in line with the specifics of data processing that AI processes and facilitates. This will involve experts in technology and financial regulations (regulators and market players) in order to establish appropriate RegTech for the use of AI in Islamic financial institutions.