This year’s Islamic Finance Country Index (IFCI) is based on our 2011 index, with two major adjustments in the methodology over the last 11 years. It uses data on the constituent factors for the year 2021 – the most recent data available at the time of analysis. To understand the methodology completely, we strongly recommend to the readers to consult previous editions of GIFR. This will also allow the keen researchers to consider how different countries have evolved in terms of their leadership role and potential in IsBF over the last decade. An update on the methodology is included in this chapter. In our view, IFCI remains the most robust measure of state of IsBF in the countries included therein.

Developed by Edbiz Consulting in 2011, the Islamic Finance Country Index (IFCI) is the oldest index for ranking different countries with respect to the state of IsBF and its relative importance in a national context and benchmarked to an international level. IFCI has evolved over the last 12 years, with two adjustments in 2018 and 2019. These adjustments aimed at normalising the data over the time series, and to reflect on our increased intelligence into some key IsBF markets (see Box 1 on Data and Methodology).

The IFCI was initiated with the aim to capture the growth of the industry, and to provide an annual assessment of the state of IsBF in each country. With 54 countries included, the index is based on a multivariate analysis providing a comprehensive assessment of the situation of IsBF in the countries included in the sample. It doesn’t claim to capture the whole of global Islamic financial services industry. Nevertheless, it is a useful snapshot of the industry as a whole. The important variables, as identified by the multivariate analysis, provide an accurate assessment of IsBF in each country.

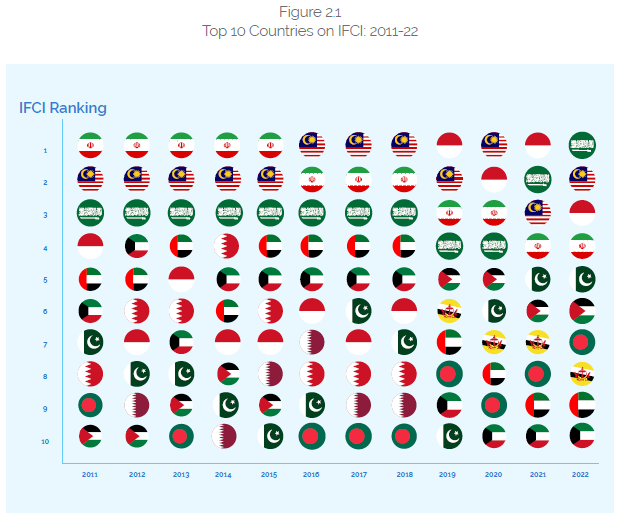

With the 11-year data since its inception, IFCI can now be used to compare the countries not only with each year but also over time. As more countries open up to IsBF, the index will provide a benchmark for nations to track their performance against others. Over time, the individual countries on the index should also be able to track and assess their own performance. Figure 2.1 presents the top 10 countries on IFCI since its inception.

The future of IsBF is in the countries with large Muslim populations

Following are some of the important observations evident in Figure 2.1:

- Saudi Arabia has emerged as the Number One Islamic financial market since the start of IFCI in 2011. This is primarily because of the proactive role played by the Saudi Central Bank, which has for the last few years explicitly started not only recognising IsBF but has also taken measures to promote the industry.

- Given that there are only 12 countries featuring in the Top 10 IFCI countries over the period of 12 years, the IsBF as a global phenomenon remains highly concentrated.

- The Top 3 IFCI countries were not challenged by anyone of those below the ranking except lately when Indonesia captured the first position in 2019. Indonesia is now considered as a player with potential to lead the global Islamic financial services industry. Its drop from the first position to the third shouldn’t be taken against the government efforts that otherwise have been very conducive to the development of IsBF. Saudi Arabia and Malaysia have edged Indonesia because of the inherent strengths of their respective IsBF sectors.

- Iran is the largest contributor to the global Islamic financial assets. Nevertheless, its isolation from the international financial markets (due largely to the international sanctions) and its rather conservative approach to communicating major developments in its national sector have contributed to its sliding down the IFCI ranking over the years. This year, however, it has held to its last year’s position.

- Interestingly, the representation of the countries comprising the Gulf Cooperation Council (GCC) is decreasing, as IFCI is becoming more inclusive in its results. The likes of Indonesia, Iran, Pakistan and Bangladesh (the countries with the larger Muslim populations) have started dominating the ranking. This must be used to infer that the future of IsBF is in the countries with large Muslim populations.

- Having said that, Saudi Arabia is a rising star.

The Case of Saudi Arabia

While Saudi Arabia for long remained the largest Islamic financial market (excluding Iran) in terms of the assets under management of the institutions offering Islamic financial services, it was not able to climb up to the first position due to less than required support and advocacy of IsBF on behalf of the government and the regulators. When the situation started improving with respect to the latter, its numbers on IFCI started improving. Now there is a clear indication that Saudi Arabia would like to emerge as an unrivalled global leader in IsBF. Even if the physical location of multilateral institutions like Islamic Development Bank (IsDB) is not considered, Saudi Arabia is certainly an interesting case. The regulators (SAMA and CMA) and other public bodies have now started recognising special needs of Islamic financial institutions. Although these institutions seem to be hesitant to be seen as promoting IsBF, there is clear indication that explicit reference to IsBF is now becoming frequent.

Saudi Arabia Compared with the Main Challengers

Due to rather historical indifference to IsBF in Saudi Arabia, it couldn’t be recognised as Number One Islamic financial market, despite having the largest national Islamic financial sector in the countries comprising the OIC. Other such countries, like Turkey and Indonesia, have shifted to an explicit advocacy of IsBF, which has perhaps pushed Saudi Arabia to follow the suit. Consequently, now it is playing a more confident role in the advocacy of IsBF. Saudi Arabia has this year attained Number One position on IFCI. At least three factors may be cited to have contributed to this result.

- The Role of Regulators

As mentioned earlier, Saudi Central Bank (SAMA) – under the leadership of the incumbent governor, Dr Fahad Abdullah Almubarak – has now not only become more active in providing a level-playing field to Islamic banking and finance, but has also emerged as an advocate and champion of IsBF globally.

This was not the case before him, despite Saudi Arabia having provided support to IsBF in a rather non-celebrated manner. This is certainly a factor that has contributed to the success of Saudi Arabia on IFCI. This is now consistent with other countries like Malaysia and Indonesia, which are playing leadership roles in the global Islamic financial services industry.

The legacy situation is being fast rectified in Saudi Arabia. SAMA has since 2019 issued several directives for Islamic banks. It has now issued its long-awaited Shari’a Governance Framework (SGF) which has been enforced since February 2020. This is an excellent document that is consistent with other such frameworks introduced in other countries. Yet it has introduced some country-specific requirements. Saudi Arabia Islamic Finance Report – jointly produced by IFSB and SAMA – clearly indicates the intent of Saudi Arabia to lead the global Islamic financial services industry.

- The COVID-19 as a Disruption

Saudi Arabia is one of the shining stars when it comes to responding to COVID-19 and managing the pandemic. Consequently, all sectors in the country – including IsBF – have grown significantly. The strict regime it created in this respect helped all the sectors in the country to continue to focus on their main activities.

This has resulted in better performance of Saudi Arabia on the IFCI, helping it to surpass the likes of Malaysia and Indonesia, which still remain in the race for global leadership in IsBF.

However, one may argue that the COVID-19 is not going to be a sustainable disruptor. Whether this is true or not, only the time will tell, but there is no denial of the fact that the FinTech focus that COVID-19 has brought to the Kingdom is going to help further develop IsBF therein.

- Political Uncertainty

Political certainty in Saudi Arabia has brought huge economic benefits. The Saudi Ministry of Finance pre-budget statement on September 30, 2022, indicates continuous progress in economic growth, consistent with the 2021 performance (on which IFCI data is based). This future forecast also helped its IFCI improvement.

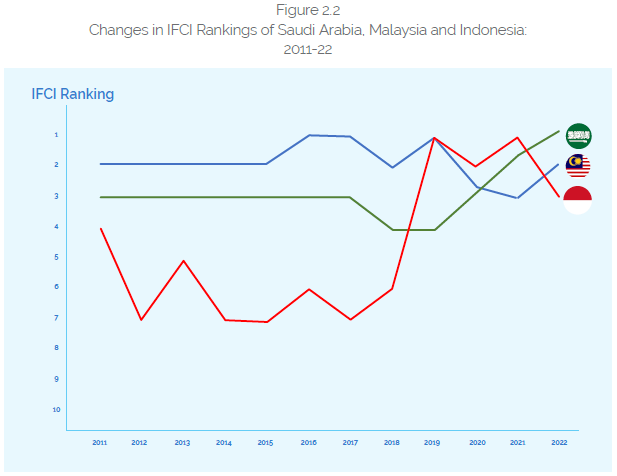

Figure 2.2 provides a comparison of IFCI rankings for Saudi Arabia, Malaysia and Indonesia over the 2011-22 period. It is already embedded in Figure 2.1, but it was intended to explicate the comparison by way of a separate graph.

IFCI 2022

Table 2.1 presents the latest IFCI scores and ranks. It must be reported that the average IFCI score decreased by 0.13 points or 0.63%, implying stagnation in the development of global Islamic financial services between 2020 and 20214. This should be a cause of concern for the industry leaders and advocates, as there is a clear indication that the industry is not growing as comprehensively as is otherwise evidenced by the simple growth in the global Islamic financial AUM.

As reported in Chapter 1, the global Islamic financial assets grew by 8.06% (Table 1.1), IFCI’s marginal increase suggests that other aspects of the development of IsBF (i.e., education, regulation and Shari’a assurance) did not witness as much advancement.

This finding has significant implications for a futuristic approach to IsBF. Successive editions of GIFR over the last one decade have consistently suggested to take a global strategic position to grow the industry in a sustainable and meaningfully relevant manner to the global financial markets. Unfortunately, the stakeholders of the industry have not taken this proposal seriously.

This is perhaps the best time to start developing a uniquely differentiable economic value proposition of IsBF, if the industry wishes to grow itself to the future financial requirements of the communities it is attempting to serve. Without it, there is a danger that IsBF would either fizzle away completely or become a nondifferentiable segment of the global financial market. If that happens, IsBF will be swallowed by the very financial system it attempted to compete with.

Average IFCI score decreased by 0.13 points or 0.63%, implying stagnation in the development of global Islamic financial services between 2020 and 2021; This should be a cause of concern for the industry leaders and advocates, as there is a clear indication that the industry is not growing as comprehensively as is otherwise evidenced by the simple growth in the global Islamic financial AUM

Following are some of the important observations:

- Saudi Arabia has gained Number One position for the first time, with 84.21 score, overtaking Indonesia (IFCI score: 81.49) – an otherwise aggressive contender for the top spot. Saudi Arabia has also surpassed Malaysia (IFCI score: 81.93) in the process.

Table 2.1 Latest IFCI Scores and Ranks

| Countries | 2022 Score | 2021 Score | Change in Score 2021- 21 | % Change in Score 2021- 22 | 2022 Rank | 2021 Rank | Change in Rank |

| Saudi Arabia | 84.21 | 80.67 | 3.54 | 4.39 | 1 | 2 | 1 |

| Malaysia | 81.93 | 80.01 | 1.92 | 2.40 | 2 | 3 | 1 |

| Indonesia | 81.49 | 83.35 | -1.86 | -2.23 | 3 | 1 | -2 |

| Iran | 79.73 | 79.73 | -0.17 | -0.21 | 4 | 4 | 0 |

| Pakistan | 63.21 | 60.23 | 2.98 | 4.95 | 5 | 5 | 0 |

| Sudan | 60.63 | 59.01 | 1.62 | 2.75 | 6 | 6 | 0 |

| Bangladesh | 56.79 | 48.56 | 8.23 | 16.95 | 7 | 8 | 1 |

| Brunei Darussalam | 56.32 | 55.01 | 1.31 | 2.38 | 8 | 7 | -1 |

| United Arab Emirates | 50.54 | 47.94 | 2.6 | 5.42 | 9 | 9 | 0 |

| Kuwait | 45.31 | 44.04 | 1.27 | 2.88 | 10 | 10 | 0 |

| Bahrain | 35.55 | 32.09 | 3.46 | 10.78 | 11 | 12 | 1 |

| Turkey | 33.69 | 33.45 | 0.24 | 0.72 | 12 | 11 | – 1 |

| Qatar | 33.33 | 32.01 | 1.32 | 4.12 | 13 | 13 | 0 |

| Oman | 31.13 | 29.67 | 1.46 | 6.92 | 14 | 14 | 0 |

| Jordan | 29.05 | 28.82 | 0.23 | 0.80 | 15 | 15 | 0 |

| Egypt | 22.21 | 21.92 | 0.29 | 1.32 | 16 | 16 | 0 |

| Nigeria | 20.99 | 18.11 | 2.88 | 15.90 | 17 | 19 | 2 |

| Kazakhstan | 20.93 | 20.89 | 0.04 | 0.19 | 18 | 17 | -1 |

| United Kingdom | 19.11 | 18.18 | 0.93 | 5.12 | 19 | 18 | -1 |

| Morocco | 13.23 | 9.99 | 3.24 | 34.43 | 20 | 21 | 1 |

| Afghanistan | 9.99 | 10.01 | -0.02 | -0.22 | 21 | 20 | – 1 |

| Tunisia | 9.56 | 8.89 | 0.67 | 7.54 | 22 | 22 | 0 |

| Lebanon | 9.23 | 8.56 | 0.67 | 7.83 | 23 | 23 | +3 |

| Djibouti | 9 | 24 | NEW | ||||

| United States of America | 8.87 | 7.77 | 1.12 | 14.41 | 25 | 24 | -1 |

| Kenya | 8.67 | 7.46 | 1.21 | 16.22 | 26 | 25 | -1 |

| Somalia | 8.45 | 27 | NEW | ||||

| Senegal | 8.34 | 7.19 | 1.15 | 15.99 | 28 | 27 | -1 |

| South Africa | 8.01 | 7.11 | 0.9 | 12.66 | 29 | 28 | -1 |

| Yemen | 7.01 | 6.98 | 0.03 | 0.43 | 30 | 29 | -1 |

| Maldives | 7.01 | 30 | NEW | ||||

| Sri Lanka | 6.69 | 7.33 | -0.65 | -8.73 | 31 | 26 | -5 |

| Switzerland | 6.56 | 6.01 | 0.55 | 9.16 | 32 | 30 | -2 |

| Singapore | 5.99 | 5.67 | 0.32 | 5.64 | 33 | 31 | -2 |

| Algeria | 5.89 | 5.45 | 0.44 | 8.07 | 34 | 32 | -2 |

| Azerbaijan | 5.5 | 4.77 | 0.73 | 15.30 | 35 | 33 | -2 |

| The Kyrgyz Republic | 4.41 | 2.23 | 1.18 | 36.53 | 36 | 34 | -2 |

| Canada | 3.34 | 3.01 | 0.33 | 10.96 | 37 | 35 | -2 |

| Thailand | 3.01 | 2.89 | 0.12 | 4.15 | 38 | 36 | -2 |

| Palestine | 3 | 2.67 | 0.33 | 12.36 | 39 | 37 | -2 |

| Ethiopia | 2.98 | 40 | NEW | ||||

| Australia | 2.56 | 1.99 | 0.57 | 28.64 | 41 | 39 | -2 |

| Tajikistan | 2.33 | 1.81 | 0.52 | 28.73 | 42 | 40 | -2 |

| India | 2.25 | 2.23 | 0.02 | 0.90 | 43 | 38 | -5 |

| Russian Federation | 1.55 | 1.76 | -0.21 | -11,93 | 44 | 41 | -3 |

| Syria | 1.52 | 1.49 | 0.03 | 2.01 | 45 | 42 | -3 |

| Germany | 1.51 | 1.47 | 0.04 | 2.72 | 46 | 43 | -3 |

| The Philippines | 1.39 | 1.32 | 0.07 | 5.30 | 47 | 44 | -3 |

| Ghana | 1.31 | 1.22 | 0.09 | 7.38 | 48 | 45 | -3 |

| Mauritius | 1.23 | 1.01 | 0.22 | 21.78 | 49 | 46 | -3 |

| China | 0.8 | 0.78 | 0.02 | 2.56 | 50 | 47 | -3 |

| France | 0.79 | 0.76 | 0.03 | 3.95 | 51 | 48 | -3 |

| Gambia | 0.78 | 0.7 | 0.08 | 11.43 | 52 | 49 | -3 |

| Spain | 0.67 | 0.55 | 0.12 | 21.82 | 53 | 50 | -3 |

Malaysia had dominated the index since 2011, being number one in 2016, 2017, 2018 and 2020. Before that, Iran held the coveted position. However, despite the large domestic financial sector, Iran continues to experience stagnation in its approach to developing a vibrant Islamic financial sector with a global relevance. As Figure 2.2 suggests, Saudi Arabia, Malaysia and Indonesia are going to compete aggressively to maintain their global leadership in IsBF.

- Saudi Arabia is emerging as a serious contender for the first position and all those countries in the race must be aware of the potential of the country to play a leadership role in the global Islamic financial services industry. Given the emphasis on FinTech in the Kingdom, the growth in IsBF in the years to come is imminent.

- There is no change in ranks of 11 countries (Iran, Pakistan, Sudan, UAE, Kuwait, Qatar, Oman, Jordan, Egypt, Tunisia and Lebanon) but apart from Iran, these countries have witnessed improvement in their score.

Saudi Arabia climbed up one place to capture the first position on IFCI

- This year, there is a significant variation in the sample. Apart from the above and the following five countries, all others witnessed improvement in their scores.

- There are five countries in the sample, namely, Indonesia, Iran, Afghanistan, Sri Lanka and the Russian Federation, which have experienced decrease in their IFCI Scores.

- 33 countries moved down the IFCI ranking. This should not mislead the reader, as downward movement does not suggest any deterioration in the global community of Islamic financial markets. More important is the improvement in ranking. Only 6 countries (Saudi Arabia, Malaysia, Bangladesh, Bahrain, Nigeria and Morocco) have improved in their rankings. As these countries happen to be on the top of the list, it resulted in the disturbance of rankings of the countries below the list.

- Four new countries (Djibouti, Somalia, Maldives and Ethiopia) were included in the sample, which captured 24th, 27th, 30th and 40th positions, respectively, on IFCI.

- Although Nigeria jumped up 2 positions to enter the Top 20 Elitist Group, the real beneficiary in this year’s ranking are the new-comers, namely Djibouti (IFCI score: 9.00), Somalia (IFCI score: 8.45), Maldives (IFCI score: 7.01) and Ethiopia (2.98). Djibouti has been an important exclusion from IFCI despite it having developed a vibrant national Islamic financial sector5. Somalia is another important inclusion, as it had been excluded primarily due to the political unrest in the country and the consequent lack of access to the reliable data. Maldives was another important exclusion. Ethiopia is a new entry after the incumbent prime minister, Abiy Ahmed Ali, introduced favourable legislation to (re-) introduce Islamic banking in the country6.

- Another beneficiary is Bangladesh that climbed one position to become the seventh most important Islamic financial market in the world. Bangladesh has fast emerged as an important Islamic financial market in the recent years, and it is expected that it will move ahead in its ranking in the years to come.

- Apart from Saudi Arabia, all other countries in the GCC region do not feature in the Top 10 List, primarily because of their very small populations. However, they remain important Islamic financial markets and are collectively considered as global hotspot for Islamic capital.

- IFCI is different from other similar indexes. For example, another index – Islamic Finance Development Indicator (IFDI) – ranks the GCC countries significantly higher than IFCI (see Table 2.2). It must be clarified that the discrepancy of such rankings is primarily because of the different underlying methodologies. While IFDI is constructed around qualitative developments, knowledge, governance, awareness and CSR, IFCI takes a very different quantitative approach (see the Box on IFCI Methodology at the end of this chapter).

Classification of Countries with Respect to IFCI

Table 2.3 provides the latest IFCI scores, and classifies the countries in terms of:

- Insignificant: The countries with the latest IFCI score of less than or equal to 10 (IFCI ≤ 10);

- Marginal: The countries with the latest IFCI score of more than 10 but less than or equal to 20 (10 < IFCI ≤ 20);

- Moderate: The countries with the latest IFCI score of more than 20 but less than or equal to 30 (20 < IFCI ≤ 30);

- Significant: The countries with the latest IFCI score of more than 30 but less than or equal to 40 (30 < IFCI ≤ 40);

- Exceptional: The countries with the latest IFCI score of more than 40 (IFCI > 40); and

- Highest: The country that tops the list (in this case, Indonesia, which has an IFCI score of 83.35).

Table 2.2 Summary of Classification of Countries in Terms of Significance

| Rankings | IFCI | IFDI |

| 1 | Indonesia | Malaysia |

| 2 | Saudi Arabia | Indonesia |

| 3 | Malaysia | Saudi Arabia |

| 4 | Iran | Bahrain |

| 5 | Pakistan | United Arab Emirates |

| 6 | Sudan | Jordan |

| 7 | Brunei Darussalam | Pakistan |

| 8 | Bangladesh | Kuwait |

| 9 | United Arab Emirates | Oman |

| 10 | Kuwait | Maldives |

There are still less than 20 countries where IsBF has assumed meaningful relevance to the mainstream banking and finance

There are still less than 20 countries where IsBF has assumed meaningful relevance to the mainstream banking and finance. It is an important observation, and the likes of IMF must take note of this for its Financial Sector Assessment Programme (FSAP) for the countries with significant Islamic banking shares. As stated earlier, there are only 12 countries that fulfil the 15% Islamic banking threshold of the IMF. There is a need to extend this list to at least 19 for such purpose. In addition to the IMF, Islamic Development Bank (IsDB) must also devise an Islamic Financial Sector Assessment Programme (IFSAP) for its member countries for which IFCI rankings may be relevant. It is also high time that other industry infrastructure bodies (like AAOIFI and IFSB) must start taking note of IFCI, given its time series benefits emanating from it being the oldest index of its kind.

Table 2.3 Classification of Countries in Terms of Significance

| Countries | 2022 Score | 2022 Rank | Classification |

| Saudi Arabia | 84.21 | 1 | Highest |

| Malaysia | 81.93 | 2 | Exceptional |

| Indonesia | 81.49 | 3 | Exceptional |

| Iran | 79.56 | 4 | Exceptional |

| Pakistan | 63.21 | 5 | Exceptional |

| Sudan | 60.63 | 6 | Exceptional |

| Bangladesh | 56.79 | 7 | Exceptional |

| Brunei Darussalam | 56.32 | 8 | Exceptional |

| United Arab Emirates | 50.54 | 9 | Exceptional |

| Kuwait | 45.31 | 10 | Exceptional |

| Bahrain | 35.55 | 11 | Significant |

| Turkey | 33.69 | 12 | Significant |

| Qatar | 33.33 | 13 | Significant |

| Oman | 31.13 | 14 | Significant |

| Jordan | 29.05 | 15 | Moderate |

| Egypt | 22.21 | 16 | Moderate |

| Nigeria | 20.99 | 17 | Moderate |

| Kazakhstan | 20.93 | 18 | Moderate |

| United Kingdom | 19.11 | 19 | Marginal |

| Morocco | 13.23 | 20 | Marginal |

| Afghanistan | 9.99 | 21 | Insignificant |

| Tunisia | 9.56 | 22 | Insignificant |

| Lebanon | 9.23 | 23 | Insignificant |

| Djibouti | 9 | 24 | Insignificant |

| United States of America | 8.89 | 25 | Insignificant |

| Kenya | 8.67 | 26 | Insignificant |

| Somalia | 8.45 | 27 | Insignificant |

| Senegal | 8.34 | 28 | Insignificant |

| South Africa | 8.01 | 29 | Insignificant |

| Yemen | 7.01 | 30 | Insignificant |

| Maldives | 7.01 | 30 | Insignificant |

| Sri Lanka | 6.69 | 31 | Insignificant |

| Switzerland | 6.56 | 32 | Insignificant |

| Singapore | 5.99 | 33 | Insignificant |

| Algeria | 5.89 | 34 | Insignificant |

| Azerbaijan | 5.5 | 35 | Insignificant |

| The Kyrgyz Republic | 4.41 | 36 | Insignificant |

| Canada | 3.34 | 37 | Insignificant |

| Thailand | 3.01 | 38 | Insignificant |

| Palestine | 3 | 39 | Insignificant |

| Ethiopia | 2.98 | 40 | Insignificant |

| Australia | 2.56 | 41 | Insignificant |

| Tajikistan | 2.33 | 42 | Insignificant |

| India | 2.25 | 43 | Insignificant |

| Russian Federation | 1.55 | 44 | Insignificant |

| Syria | 1.52 | 45 | Insignificant |

| Germany | 1.51 | 46 | Insignificant |

| The Philippines | 1.39 | 47 | Insignificant |

| Ghana | 1.31 | 48 | Insignificant |

| Mauritius | 1.23 | 49 | Insignificant |

| China | 0.8 | 50 | Insignificant |

| France | 0.79 | 51 | Insignificant |

| Gambia | 0.78 | 52 | Insignificant |

| Spain | 0.67 | 53 | Insignificant |

Box 1 ISLAMIC FINANCE COUNTRY INDEX – IFCI 2022 | 02

A NOTE ON DATA AND METHODOLOGY

IFCI is based on a multivariate analysis. For construction of the index, original dataset included information on several variables, including macroeconomic indicators of the countries included, for the year 2010. The data was tested to see if it contained any meaningful information to draw conclusions from. After consideration of different multivariate methods, it was decided to use factor analysis to identify the factors that may influence IsBF in the countries included in the sample.

For factor analysis to be applicable, it is important that the data fits a specification test for such an analysis. The Kaiser-Meyer-Oklin (KMO) measure of sampling adequacy was used to compare the magnitudes of the observed correlation coefficients in relation to the magnitudes and partial correlation coefficients. Large values (between 0.5 and 1) indicate that factor analysis is an appropriate technique for the data at hand. If the value is less than that, then the results of the factor analysis may not be very useful. For the data we used, we found the measure to be 0.85, which made it reasonable for us to use factor analysis.

Bartlett’s test of sphericity is another specification test that tests the hypothesis that the correlation matrix is an identity matrix indicating that the given variables are unrelated and therefore unsuitable for structure design. Smaller values (less than 0.05) of the significance level indicate that factor analysis may be useful with the data. For the present purposes, this value was found to be significant (0.00 level), which means that data was fit for factor analysis.

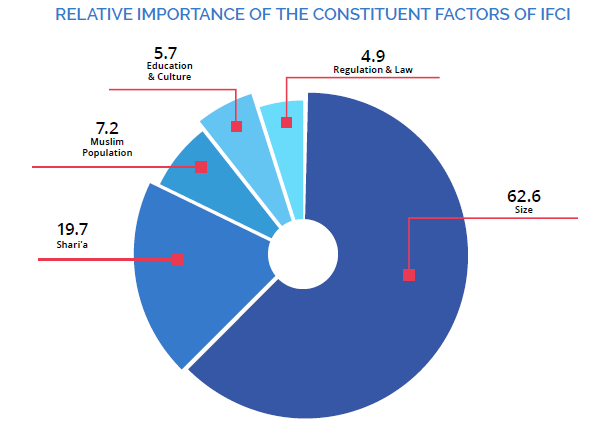

Factor analysis was therefore run to compute initial communalities to measure the proportion of variance accounted for in each variable by the rest of the variables. In this manner, we were able to assign weights to all eight factors in an objective manner.

By following the above method, we were able to remove the subjectivity in the index. The weights along with the identified factors make up the IFCI. The weights point to the relative importance of each constituent factor of the index in determining the rank of an individual country.

There are over 70 countries involved in IsBF in some way or another. However, due to limitations imposed by authenticity, availability, and heterogeneity of the data, IFCI was launched in 2011 with only 36 countries. Over the next three years, the availability of data allowed us to include another six countries to make the sample size of 42. The current sample stands at 50, and we believe that this is a robust enough number to analyse the state of affairs of the global Islamic financial services industry. Information contents of the data for other countries is not instructive at all.

The data used comes from different primary and secondary sources, but in its collective final form becomes the proprietary data set of Edbiz Consulting, which collects, collates and maintains it.

We collect annual data on eight factors/variables for the countries included in IFCI. The variable and their respective weights are described in the following table.

CONSTITUENT VARIABLES/FACTORS OF IFCI AND THEIR DESCRIPTION AND WEIGHTS

| Variables/Factors | Description | Weights | |

| 1 | Number of Islamic Banks | Full-fledged Islamic banks both of local and foreign origin | 21.8% |

| 2 | Number of IsBFIs | All banking and non-banking institutions involved in IsBF, including Islamic windows of conventional banks | 20.3% |

| 3 | Shari’a Supervisory Regime | Presence of a state (or non-state) representative central body to look after the Shari’a compliancy process across the IsBFIs in a country | 19.7% |

| 4 | Islamic Financial Assets | Islamic financial assets under management of Islamic and conventional institutions | 13.9% |

| 5 | Muslim Population | Absolute number of Muslims | 7.2% |

| 6 | Sukuk | Total sukuk outstanding in the country | 6.6% |

| 7 | Education & Culture | Presence of an educational and cultural environment conducive to operations of IBFIs, including formal Islamic finance professional qualifications, degree courses, diplomas and other dedicated training programmes | 5.7% |

| 8 | Islamic Regulation & Law | Presence of regulatory and legal environment enabling IBFIs to operate in the country on a level-playing field (e.g., and Islamic banking act, Islamic capital markets act, takaful act etc.) | 4.9% |

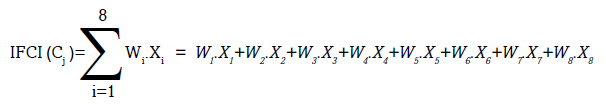

The general model used for the construction of IFCI is as follows:

where

Cj = Country j including in the index

Wi = Weight attached to a given variable/factor i Xi = A given variable/factor I included in the index

The countries are ranked according to the above formula every year, using the updated annual data.

In 2016, a major adjustment exercise was undertaken to take into account some of the time-series characteristics of the data. The primary objective of this exercise was to normalise the data over the time. We adopted a methodology based on a weightage system that we adopted to construct a normalising factor.

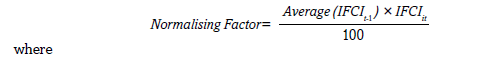

The normalising factor used in the adjusted IFCI was calculated by the following formula:

Average(IFCIt-1)= Average of IFCI scores for all the countries included in the sample of the previous year (t-1); and

IFCIit = IFCI score for an individual country i in the current year (t).

This normalising factor allows us to neutralise the purely statistical effect of data movements on IFCI score in such a way that the overall ranking each year remains unaffected.

As the above table and figure suggest, the size of Islamic financial services industry as captured by four factors (namely, number of Islamic banks, number of IBFIs, volume of Islamic financial assets, and the sukuk outstanding) is the most important factor in the index, explaining 62.6% variation. Therefore, it is superior to the univariate analyses that focus on just size of the industry in each country. Furthermore, size on its own is not enough to capture the relative importance of IsBF in a country. It is equally important to consider the depth and breadth of the industry. Hence, both the size of Islamic financial assets and the number of IBFIs are included. Furthermore, the inclusion of sukuk, which accounts for 15% of the global Islamic financial services industry, as a separate factor is also useful.

Although the other factors collectively explain 37.4% variation in the index, their inclusion is important as they give a comprehensive view about IsBF in a country.

It must be clarified that IFCI is a positive measure of the situation of IsBF and its potential in a country, without taking a normative view on what should be the important factors determining the size and growth of the industry, and their relative importance (i.e., weights).