Introduction

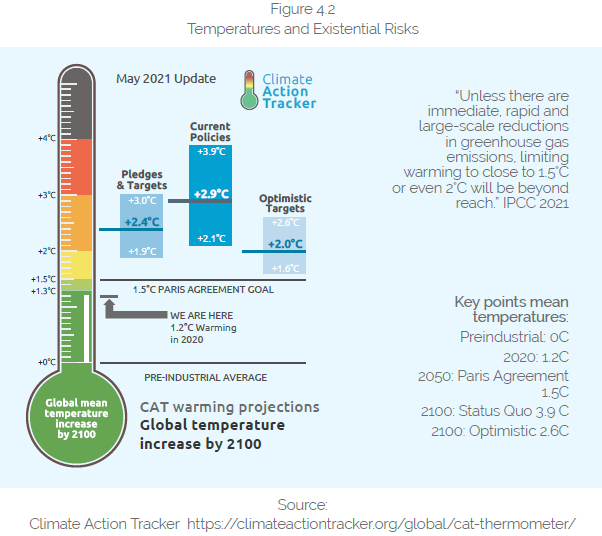

Businesses and entrepreneurs shape the economic conditions and opportunities of the world. Over the past few years, a consensus has emerged that business behaviours and practices and policies of governments and international organisations, and consumer behaviours collectively have led to global warming. This poses serious questions about the long-term sustainability of growth and development in view of its implications for the ecological boundaries and the earth’s limited resources as well social equilibrium of the society. This consensus is based on scientific data tracing about a) global mean temperatures since the beginning of the industrial age, b) ultimate limitations of exhaustible resources, c) human population growth and biodiversity loss and d) rising inequalities and social problems despite tremendous growth of global GDP. About climate change alone, projecting the trends into the future scientists warn that there are immediate, medium term and long terms existential risks if business as usual is allowed to continue (see, for example, IPCC 2021 and UNEP 2021). The global warming caused by human economic and commercial activities has been suggested the name of the epoch of Anthropocene.

Entrepreneurs take risks and drive innovations. Indeed, the economic pursuits that caused the economy to harm the ecology were entrepreneurial actions; and the healing of the ecology by the economy that is ongoing is also driven by entrepreneurial pursuits. The successful outcome depends on the paradigmatic frame of reference of success and its measurable impact on society, ecology, and economy. There is an expectation that science and religious faiths must work jointly to remediate the climate and restore the ecosystems, as a healthy and secure future for humanity rests on a healthy and sustainable ecological environment.

Islamic economics shares the universal principles of responsibility, trust, and the ideals of stewardship with other cultures. Preceding his Prophethood, Muhammad was an entrepreneur and in that secular role, he became known to the public as the truthful and the trustworthy. These were the two attributes that strengthened the credence in the public’s perception about his message of Prophethood. Rest of his life, Muhammad was the Prophet (PBUH), his life constitutes the Islam that his followers get inspiration in all walks of life including entrepreneurship and economic pursuit. As the Prophet, he was mercy for the worlds, (not only for people who believed in his message) and was praised for his exalted character. What he taught humanity by his deeds and teachings are relevant for all times. Now humanity is in the epoch of the Anthropocene – an era of destruction of the earth’s ecosystems by the economic pursuits of human beings, and we need new solutions to remediate it.

The objective of this chapter is to discuss the anthropogenic background and challenges and opportunities of climate change and its remediation. The role of entrepreneurship as a contributing factor to environmental problems and as a potential remedy in climate healing is discussed. The Islamic attributes of transformative entrepreneurship and its relevance to sustainable economic system and restoration of the ecosystems is discussed. Given the great significance of the theme, this paper can only be considered as initial, but it has the potential to initiate new thinking and further research. The paper is organized as under.

Section two explains the dominant framework in which the economy is dis-embedded from ecology and society. All the institutions of the market economy including entrepreneurship functions within the confluence of the paradigm. We also elaborate on the consequences of the entrepreneurial economy in the dis-embedded paradigm.

Section three summarizes the framework of the sustainable development goals (SDGs) as a strategic effort to develop an alternative economic paradigm in which the economy is embedded in the society, and in turn, the society is embedded in the ecological environment. This is to remove among other inconsistencies and incongruities, the cashflow paradox vis-à-vis the Tree representing embedded natural assets. We also discuss the unprecedented green economic transformation that it will require the SDGs framework to succeed and the entrepreneurial areas and business models of the circular and green economy. One major hope attached to the SDGs framework is its emphasis on localization of the SDGs. For effective implementation of SDGs in Muslim societies local aspirations and commitments in these societies is of vital importance. It is encouraging that such location aspirations represented by the maqasid al-Shari’a (Objectives of Shari’a or OS in short) are in congruence with the SDGs. Section four discusses these considerations including the attributes of Islamic climate entrepreneurship and the required ecosystem.

Section five discusses the prospects of some innovative Islamic finance for circular/green business within the framework of SDG 17, collaboration, and cooperation among stakeholders for the goals. Finally, in section six we summarize conclusions and implications of the study.

- The Dis-embedded Economy and the Anthropogenic Era

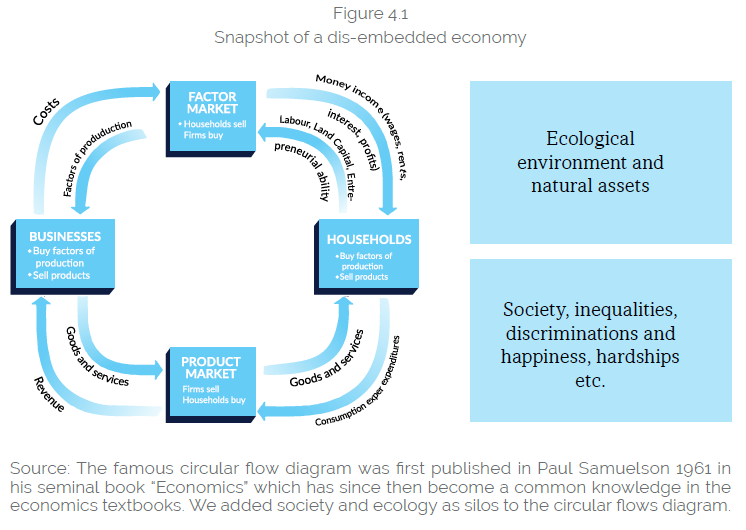

Traditional capitalist economies are characterized as dis-embedded. Figure 4.1 presents a snapshot of such an economy. Indeed, it is in fact the dominant model of contemporary economies. What is important to note is that the economy as such understood is disconnected with the complex realities of societies on one hand, and the ecological environment, planetary boundaries and the earth’s resources and natural assets on the other hand.

The Schumpeterian entrepreneurship in the dis-embedded paradigm

The concept of “creative disruption” which is the core characteristic of modern-day innovations was first coined by JA Schumpeter during the thirties to sixties in several publications including (1962). Numerous good examples of creative destruction exist including mobile phones destroying several standalone products and combining those in one small handheld device and as such creating tremendous value for the user and society. Breakthrough technologies in carbon sequestering, solar energy, storage batteries, automated electric vehicles, green food technologies etc., are bringing unprecedented disruptions but at the same time adding tremendous values to businesses, society, and ecology. The 4th Industrial Revolution is considered to make the decade of 2020-2030 as the most disruptive decade, old technologies and assets are expected to be stranded and new technologies and new products to create unprecedented values. These were envisioned by Schumpeter in his research on economic history and the role of entrepreneurs.

However, it is worth noting that Schumpeterian entrepreneurship was operating in the dis-embedded economy as the dis-embedded economy was the only possible manifestation of capitalism. Any deviation from such a paradigm was designated as seeds of socialism in the era of the cold war and ideological tensions between the US and USSR as the theme of Schumpeter’s seminal book “Capitalism and Socialism” reflects. In a note on “Can Capitalism Survive?” Schumpeter explicitly makes a case for this isolation of economics from society (and ecology), otherwise the system will be socialism with its deficiencies.

“Capitalism is that organization of society in which production is managed by private initiative with view to private profit. Needless to say, on the one hand, that this implies nothing about the social results of such an organization” … Schumpeter (1936)

The dominant economic theorems

The dominant economic theorems were in synch with each other. Rostow’s stages of economic growth, Kuznets’s environmental curve, Kuznets’s income inequality curve, Hotelling’s economics of exhaustible resources, Coase’s externalities and bargaining, Pigou’s welfare state and carbon tax – for examples; all these leading theorems and others of the discipline of economics operated within the dis-embedded economy in isolation of society and ecology.

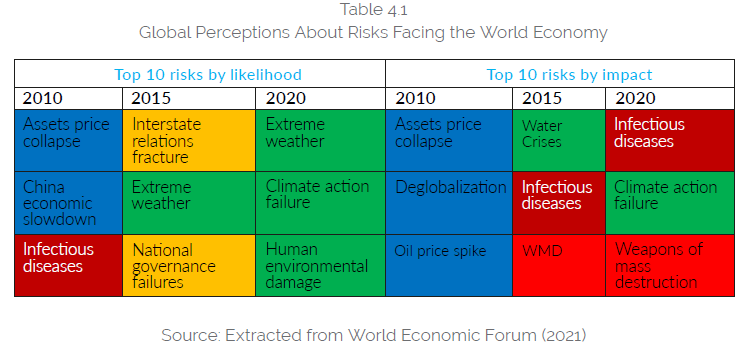

Prior to the fall of COVID-19 in December 2019, a consensus had emerged that global warming is the topmost important risk faced by humanity (see Table 4.1). The Global Risk Report 2020 was released on January 15, 2020, at the World Economic Forum (WEF 2020). As the outbreak of COVID-19 was ongoing in Wuhan, in WEF, there was a concern about climate change, but no one was expecting of a global-sudden-stop because of another event related to the lopsided relationship of human beings with the ecology.

Human beings are linked to ecology primarily through the economy. In his influential economic rule described in “The Economics of Exhaustible Resources”, Hotelling (1931) made the case for transforming natural resources into manmade resources through the financial intermediation process. In relation to human interaction with ecology, the Hoteling rule of thumb is simple. If there is a tree, and it is cut and transformed into timber, say its cash value is US$100. If the current saving accounts interest rates are 5%. If the tree is not cut and sold for US$100 and deposited in the bank for 5% interest income, next year the market value of the tree as timber must be at least US$106, otherwise it is beneficial to cut the tree and put the proceeds in a bank account and earn interest. This simple pivot of Hotelling rule has driven corporate strategies and public policies ever since (Costanza et al., 1997, p. 54). The essence – present cash flows are more valuable than future cash flows and hence we need to discount at the rate of interest. The consequence has been an excessive financialization – financial assets far exceeding the real economy at the cost of unprecedented ecological deterioration.

The Hotelling rule of thumb also got support from another highly influential theorem presented by Coase (1960) in “The Problem of Social Cost”. To simplify, if cutting the tree and making it timber leads to unbalancing the natural level of CO2 for the society, then this is an issue of market failure which exists due to the ambiguity of property rights and can be resolved by negotiating and bargaining, namely the timber merchant paying compensation to the society for the loss of environment to CO2. A policy framework for resolving such externality issues was earlier presented by A.C Pigou in 1928 in “The Economics of Welfare”. The “Pigouvian Tax” is now heralded as the core solution as carbon tax, for the ongoing ecological catastrophe that was only eclipsed by the COVID-19 calamity and the Great Lockdown and Universal Sudden Stop.

Schumpeterian entrepreneurship, a Hotelling philosophy, supplemented by the Coase’s bargaining and the Pigouvian tax are the four pillars of economic policies that have led to excessive financialization and extracting resources beyond natural boundaries. Waste in land fields and waters, plus CO2 fumes of incineration and industries, agriculture and transport, gross deforestation have aggravated the ecological balance.

Grave pitfalls of the dis-embedded economic framework

Immediate risks to global economy

We already mentioned above about the sudden emerge of the climate risk. The Global Risk Report is an important document released by the WEF every year. Table 1 reproduces an abstract of the top three risks reported for 2010, 2015, 2020. We can see that the risks for 2020 are all related to climate.

Existential threats of temperatures

The rise of global mean temperatures could have an existential consequence for the earth’s environmental sustainability. Figure 4.2 shows that if nothing is done as policy measures, the temperatures will rise to 3.9oC over the pre-industrial age. Considering that, our current temperatures are 1.2oC with already noticeable climate disasters, 3.9oC could really be catastrophic. The challenge is so desperate that the Paris Agreement sets the targets at 1.5oC but most scientists argue that 2oC is more realistic if commitments are faithfully enforced and hence climate adaptation is critical.

In the embedded economy, such an enormity of the Anthropocene was eclipsed by concepts such as externalities, financial rate of return, cash flows and the competition of capitalism with socialism. Now since the world’s scientific community has validated the real existential threat of the Anthropocene, the search for the climate remediation has become the pivotal subject for entrepreneurs and their businesses. Scientists show that global warming is the result of human economic, commercial, and financial activities. Hence it is established that entrepreneurs have a great responsibility with respect to the ecological boundaries of the earth.

- Sustainable Development Goals and the Embedded Economies

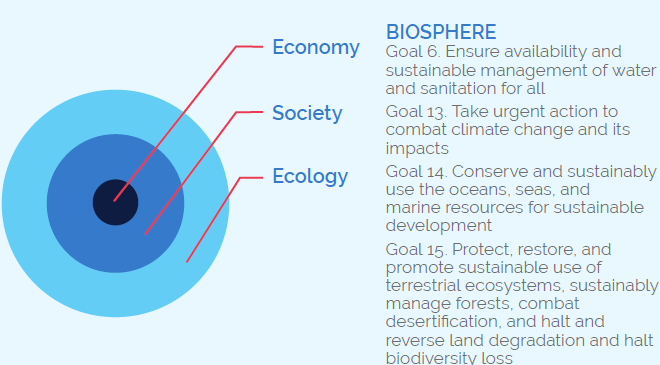

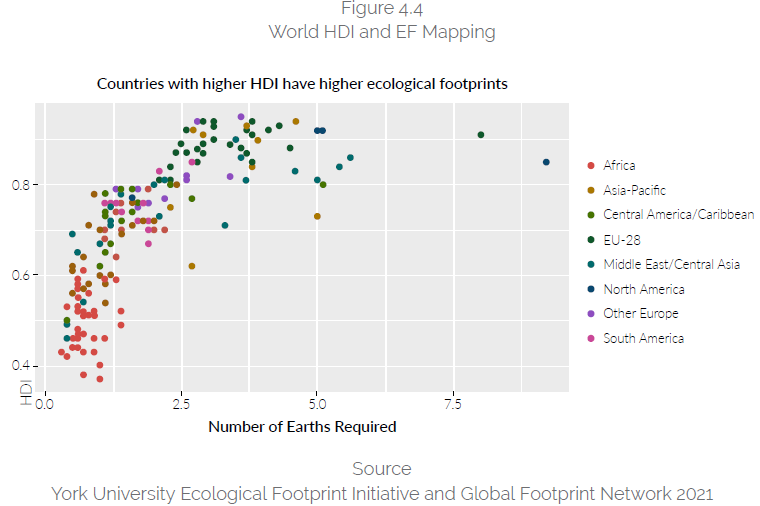

Departing from the existing dominant dis-embedded paradigm, the United Nations sustainable development goals (SDGs) utilize the new paradigmatic methodology to embed the ecological environment, society, and economy in one integrated system of inseparable elements. Healthy planet earth is a must for healthy society and a thriving economy. Four of the 16 SDGs are directly related to the biosphere, eight of the 16 SDGs are related to the society, and four SDGs to the economy. The 17th SDGs provides for a coordinated and collaborative effort of stakeholders. Figure 4.3 provides a snapshot of this embedded framework. However, for the different goals to progress together, there is a need for a paradigm to hold the goals together as in the following we show that historically in the dis-embedded system, the different goals have been in conflict as shown in Figure 4.4.

Figure 4.3 SDGs in the Embedded Framework

SOCIETY

Goal 1. End poverty in all its forms everywhere

Goal 2. End hunger, achieve food security and improved nutrition and promote sustainable agriculture

Goal 3. Ensure healthy lives and promote well-being for all at all ages

Goal 4. Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all

Goal 5. Achieve gender equality and empower all women and girls

Goal 7. Ensure access to affordable, reliable, sustainable, and modern energy for all

Goal 11. Make cities and human settlements inclusive, safe, resilient, and sustainable

Goal 16. Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable, and inclusive institutions at all levels

BIOSPHERE

Goal 6. Ensure availability and sustainable management of water and sanitation for all

Goal 13. Take urgent action to combat climate change and its impacts

Goal 14. Conserve and sustainably use the oceans, seas, and

marine resources for sustainable development

Goal 15. Protect, restore, and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss

ECONOMY

Goal 8. Promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all

Goal 9. Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation

Goal 10. Reduce inequality within and among countries

Goal 12. Ensure sustainable consumption and production patterns

Misalignment of HDI and ecological sustainability

It is very pertinent to note that the next ten years will be celebrated by the UN as Ecosystems Restoration Decade. These are the 10 years left in the timeline of SDGs. It signifies the basic fact that restoration of the ecosystem is the precondition for achieving the SDGs.

SDG 17 is in fact a call for coordinated efforts by the stakeholders. The other 16 SDGs are related to two overarching global policy themes that have diverged historically in the dis- embedded economies. These are: a) the UN Human Development Index (HDI) and b) Ecological Footprint Indicators (EF).

The HDI from 0.8 to 1.0 is considered the highest to be targeted by all countries. All developed and some emerging countries like Malaysia for example, have achieved this level of high HDI. Most least-developed countries have HDI lesser than 0.5. Pakistan’s HDI for example, is slightly higher at 0.557.

However, what is more concerning is that the EF of the developed countries and emerging countries is much more than their one-earth capacity. On the other hand, the EF of the least developed and developing countries is mostly within the one-earth capacity. Pakistan’s EF is for example at 0.79, which is lower than its one-earth capacity. Figure 4.4 summarizes the HDI and EF data for different countries of the world signifying this divergence between HDI and EF.

Developed and emerging countries have achieved high HDI at the cost of depleting the global public asset – the earth’s ecological capacity, because of waste-driven growth policies, material footprint of resource extraction, CO2 emissions, deforestation, and climate change. If we look at the data offered in UNDP HDI format and compared it with the data on ecological footprint database maintained by York University Toronto, it is obvious that high HDI countries have very high ecological footprint.

A New Dawn of Entrepreneurship- Green Economic Transformation

The question now arises is what role entrepreneurs can play in healing ecology through their economic pursuits and innovations?

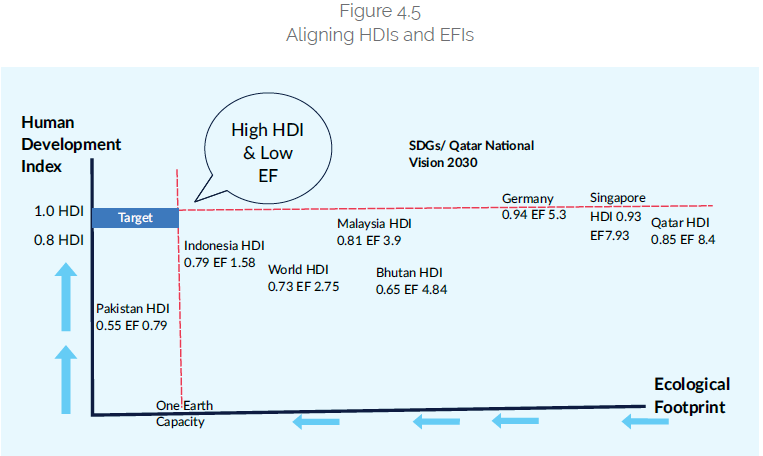

Ecosystem restoration is considered as the precondition to achieve sustainable development, and it needs nature-based economic and business activities. In Figure 4.5, we reproduce Figure 4.4 to explain the ongoing global policy target of green economic transformations (GET). GET is the realignment of HDI and EFs by adopting right policies of economic growth within the boundaries of the one planet earth. GET is healing the ecological environment through economic activities and entrepreneurial pursuits of risk-taking and introducing disruptive innovations. Most developed countries must drastically reduce their EFs, indeed without letting their HDIs to suffer. Most least developed and developing countries must enhance their HDIs without worsening their EFs by exceeding the one earth capacity. This requires resource decoupling, eliminating waste and emissions, sequestering emissions, and transitioning to a green and clean embedded economy. The transition is going to be transformative and unprecedented entailing massive entrepreneurial challenges and opportunities.

Circular economy as a paradigm for sustainability

Historically the different economic, social, and environmental parameters represented by the various SDGs have been in conflict. For example, developed countries have achieved high HDIs but with carbon-intensive ecological footprints. More recently China, India and Bangladesh have made significant progress on economic growth and reducing poverty and hunger but the quality of air and water in these countries is ranked worst in the world. Without air and water quality health cannot be improved and without good health, poverty alleviation cannot be sustainable. Therefore, there is need for a practical paradigm that addresses all these concerns simultaneously.

With such a concern for sustainability management, the regenerative and redistributive, nature-consistent circular economy paradigm is widely appraised globally. According to Stahel (2019, p 29) who is considered as the pioneer of circular economy, “The key objective of a circular industrial economy is to keep the economic value and utility of stocks of manufactured objects and materials as high as possible for as long as possible. Use (or utilisation) value is the dividend we harvest without consuming the stocks themselves”.

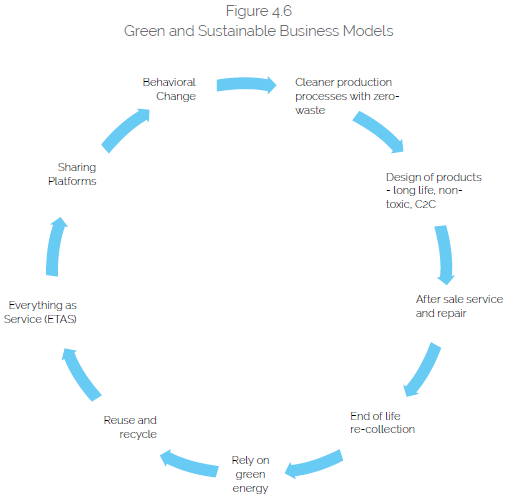

The different parameters of circular economy business models are summarized in Figure 4.6 and further elaborated in Table 4.2 creating tremendous new forms of entrepreneurial opportunities. These business models constitute the core of several strategies like the European Green Deal in implementation of the SDGs and sustainability management in that context.

The core objective of the circular/green business models is the minimization and potential elimination of negative externalities like waste, pollution, and emissions, of businesses and all economic activities through behavioural change, product design, maintenance and refurbishing, recollection of material, reuse and recycle, selling services instead of products, using technology and green energy etc. Indeed, behavioural change seems the starting difficult challenge. However, a new research EIU (2021) shows that there is a rising awareness among consumers in China, India, Pakistan, Bangladesh, Indonesia etc., about carbon footprint of products and services. This awareness has been the result of hazardous air and toxic water situations in those countries.

- Rethinking Islamic Entrepreneurship in the OS-Driven Embedded Econo- mies

The role of entrepreneurship will change if the framework in which it operates changes and integrates economy in society and ecological environment. Like the SDG framework, an integrated comprehensive development framework was presented and discussed in detail by scholars in the early period.

Table 4.2 Carbon and Waste-free Entrepreneurial Opportunities

| The Circular Business Models | Key themes of the model and areas of climate entrepreneurial opportunities |

| Zero-emissions | |

| Decarbonisation | Clean energy, major expected disruptions from a) solar, wind and hydrogen energy, b) batteries and storage systems, c) electric vehicles and d) energy transition of industries, transport and built environment. ESG investments by mutual funds, pension funds, sovereign wealth funds and central bank reserve managers. Sustainable stock markets, sukuk and bonds. Corporate sustainability and disclosure requirements. Unprecedented opportunities for medium, small, and micro-businesses Decarbonisation data and data science and advisory. |

| Carbon sequestering and ecosystems restoration | Carbon capture, storage, and recycling. Reforestation and plantations to enhance photosynthesis. Soil quality improvement to store carbon efficiently. Regenerative agriculture. Bioengineering and plant-based meat substitutes. |

| Zero-waste | |

| Refuse | Behavioural change to rationalize consumption; entrepreneurs with their outreach and publicity programs to motivate and induce such a behavioural change do not create barriers. |

| Redesign | Redesign products for durability, maintenance, disassembling of components for refurbishing and reusing. |

| Cleaner and non-toxic production processes | Increasing number of regulators EU are putting in place stringent quality control measures, specially within the framework of EU policies and other countries are following. |

| Circular supply chains | Industrial symbiosis complexes are being established to facilitate the industrial units to utilize the end-of-service products in some units as material in out in other units. |

| End-of-life recollection | Increasing number of companies are introducing recollection strategies including electronic and furniture companies, for example. |

| Product as a service | Everything as a service model is increasing as one of fastest growing business segment in areas such as transport, electronics, cloud computing and other areas. |

| Reuse and recycle | Reuse and recycle is the conventional model but due to awareness of municipalities worldwide and separation of waste at origin policies, this segment is increasing all over the world. |

| Rely on clean energy | Indeed, clean energy is the major disruption in several areas due to reduced costs of energy storage. |

| Sharing and platform economy | The rise of platform and sharing economies like Uber and Airbnb is increasingly increasing the utilization of assets. A major disruption is considered to AI EVs fleets in major cities where parking and traffic congestion has become unbearable. |

| Breakthrough technologies | A lot of investments are being made in breakthrough technologies including carbon recycling, clean energy, plant-based food industry, material separation etc., contributing to fast transition to green and circular economies. |

The OS Driven Embedded Economies

It is very interesting to find that the advantages of the integrated approach of the embedded economy was envisioned by scholars like al-Ghazali, Ibn Taimiyyah, Ibn al-Qayyim and al-Shatibi during the 12th and 14th centuries. (Chapra, 2008) presents the OS as an embedded framework for comprehensive development and Tag el-Din (2013) reinvigorated the economywide applications of this integrated approach (Khan 2019a). The current (October 27, 2021) literature on the OS has 144,000 listing on Google search engine.

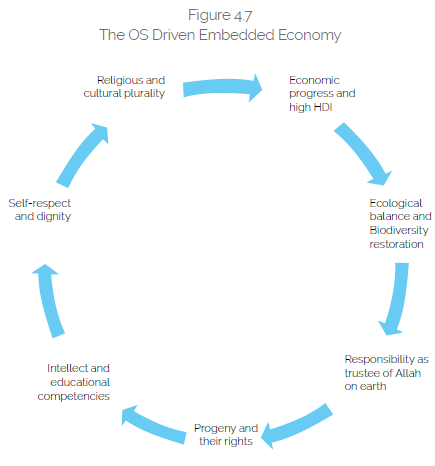

Overwhelming literature is based on five elements of the OS. Asutay and Harningtyas (2015) adopt a modified framework and added to it physical environment including wealth and ecology. Akhtar (1996), Kamali (2010) do emphasize environmental concerns in Islamic economics.

We added sixth element about ecology, restoration, and preservation of the ecosystem because of the special times of the Anthropocene. For the same reasons, we added seventh element of trust and responsibility. The extended framework is summarized in Figure 4.7. It is important to note that all the seven elements are integrated and interwoven and cannot be separated without compromising on the purpose. This framework shall be viewed as the guidepost of the transformative entrepreneurs.

Islamic Entrepreneurial Economy and Sustainability Management – Connecting the Dots

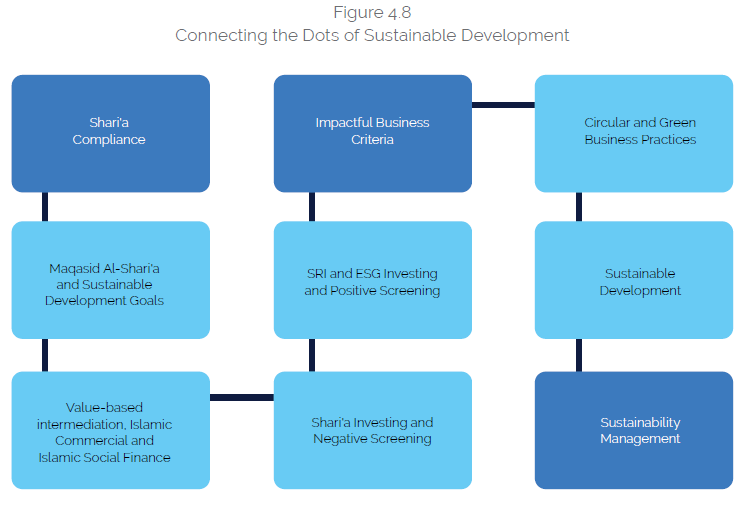

In fact, all economies are entrepreneurial in the sense that the economic and business activities are driven by the entrepreneurial acumen, and innovations. The Islamic entrepreneur’s activities start at the understanding about Shari’ a compliance – what is prohibited and what is permitted, and within those limitations the scope of guided innovations. There are indeed the rules of setting goals for business – what is best and desirable in view of the internal, external, and intergenerational and inter-species justice, equity, and balance. These considerations are enshrined in the OS and SDGs, and the practice of Islamic finance and Islamic investing.

By considering the underlying parameters of these practices and by taking a cue from ethical and sustainable finance like socially responsible investing (SRI) and environmental, social and governance (ESG) consistent investing, where positive screening is adopted, a set of comprehensive and impactful criterion for the business activities of an entrepreneur can be formulated as discussed below.

The resultant businesses to be undertaken will be characterized as Shari’a compliant, circular, and green. Connecting these dots as visualized in Figure 4.8 can facilitate sustainable development and ease sustainability management at the levels of the individual entrepreneurs as well as the governments and support organizations. This is important in view of the discussions summarized in Figures 4.4 and 4.5 about the conflict between HDI and ecological footprint and the target of green economic transformation to achieve high HDI within the one-earth capacity.

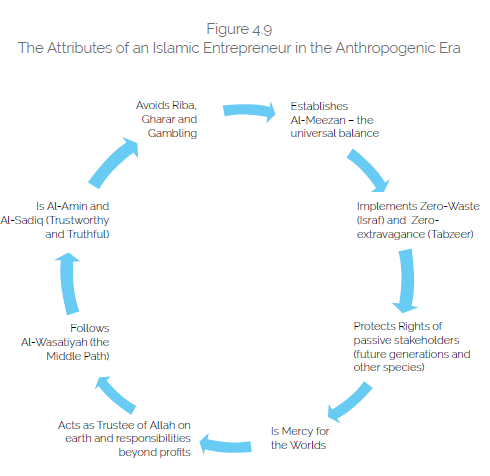

Attributes of a Transformative Islamic Entrepreneur

In Figure 4.8 and Table 4.3 we pictured the summary of the attributes of an Islamic entrepreneur. The key consideration is to strengthen the economic paradigm that embeds economy in society and in turn the society into the biosphere. Indeed, economic growth is important, and these entrepreneurial attributes are expected to develop a friendly relationship between economic growth, society’s well-being and restoration of the ecosystems and enhance ecological resilience.

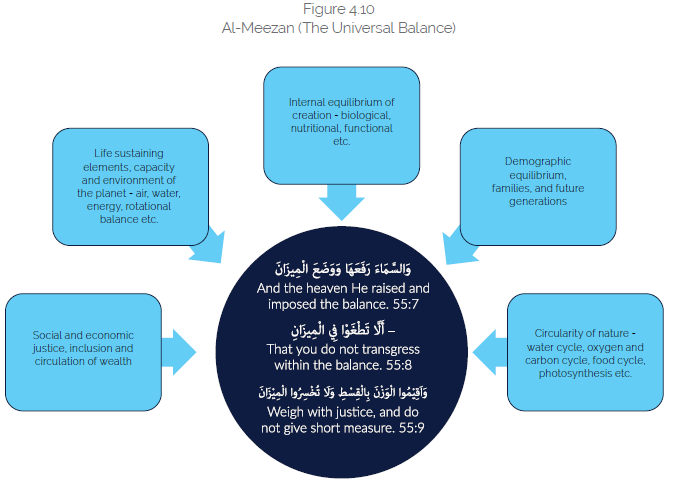

In the context of the extended Maqasid Al-Shari’a framework of Figure 4.8 and entrepreneurial attributes of Figure 4.9, the Quranic concept of Al-Meezan (the universal balance) is of great relevance. The basic concept is elaborated in Figure 4.10. The natural system of the universe, planets, society, biospheres, micro-organisms and life forms – everything, object and species is created in balance. This balance should not be disturbed, “you do not transgress within the balance” and the Anthropocene is the transgression referred to and needs to be reversed by actions foremost of those actions is the entrepreneurial behaviour.

Islamic Climate Entrepreneurship (ICE) – Preconditions of success

The Schumpeterian entrepreneurship (SE) and associated technological innovations have brought tremendous economic opportunities to the world and empowered mankind in different walks of life. However, it has also desperately failed in solving the problems of society like inequalities, poverty, diseases, discrimination etc., and has created ecological imbalances. The attributes of the Islamic climate entrepreneur (ICE) summarized in Figure 4.8 dates to the early Islamic period, however, these were overshadowed by the SE and the dis-embedded economic systems. The transformative ICE is expected to solve the problems of economy and society and will reverse the debilitating effects of global warming.

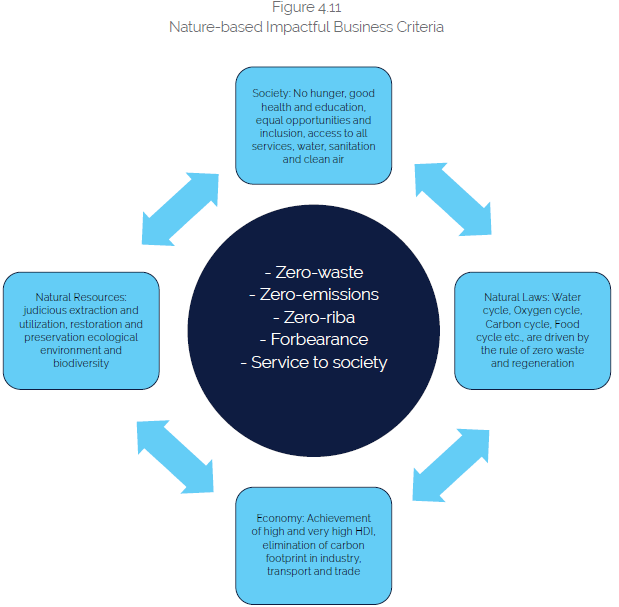

The embedded economy internalizes of what constituted externalities in the disembedded economies. This internalization has already emerged as universal impact criteria (UIC) for the ICE and responsible businesses as pictured in Figure 4.11. The UIC simply boils down to four elements, namely, zero waste, zero emissions, zero financialization and service to society. UIC is already emerging as the basis of agreement and handshake between different stakeholders including civil society, businesses, and governments.

The ICE is expected to study the problems of the economy including those of society and ecology and view these as opportunities, accepting stakes of future generations in our actions. As a foundational paradigm, the ICE is expected to learn from nature just like science has tremendously learned from nature and has practiced it through bio-mimicking. Certain core actions of the SE have given shape to the waste and emissions-driven, greed-based and excessively financialized market economies.

To reverse this process, the ICE is to shape a more compassionate and inclusive and nature-based market economy. Nature does not waste through the many natural cycles, most vital being the water, oxygen, and food cycles. Nature has no record of wasting water or oxygen and the ICE is expected to learn from nature in solving the problems of economy and ecology, while the SE has ignored the natural laws and has helped a waste and carbonized economy.

The ICE is expected to transform the instructional methods of economics and business schools and guide policies for a better world. Market discipline is already rapidly transforming banking, financial and investment services to follow the respective universal impact criteria included in the UNEP-FI’s PRIs, PRBs, PSIs and other disclosure requirements like TCFDs, ESG and SDG disclosures.

In the embedded economy, on the pivot of climate remediation, charities and businesses are expected to agree on the universal impactful business criteria and will have a beneficial handshake to promote responsible businesses. Governments and regulatory support are expected to encourage such an alignment and blending of charities and businesses.

Globally, already significant initiatives such as principles of responsible investments, banking, insurance are noteworthy. Localization of SDGs, and circular/green economies transition strategies offer a new direction. Much more needs to be achieved, to set up a new paradigm pivoting on the simultaneous healing of the ecology and economy. Therefore, the ICE’s role is more than being a responsible SE – the two work in two different and competing paradigms. The ICE nevertheless must use the “creative destruction” strategy of the SE to disrupt the disembedded economy and replace it with an embedded economy inclusive of economy, society, and ecology. For the ICE to meet the rising expectations there are certain preconditions that have to be available for certainty of policy landscape, and success of individual and institutional initiatives. We discuss these preconditions below.

Table 4.3 Elaboration on the Entrepreneurial Attributes

| Attributes | Manifestations | Relevance |

| Mercy for the Worlds | Mercy for the Worlds is a title assigned to Prophet Muhammad (PBUH) by Allah in the Holy Quran | The title covers all things, species, and human beings of all times without any prejudice and discrimination. It embeds human beings with other species; it links self-interest with interest of others; and integrates interests of current generations with future generations |

| Trustee of Allah on earth | Role assigned to mankind in the Quran by Allah | Assigns human beings the highest degree of responsibility with respect to all aspects of life and in relationship with other species and the ecosystems |

| Truthful and Trustworthy | Titles given to Muhammad (PBUH) by the public because of the credibility of his social dealings and interactions | Being truthful, trustworthy in public dealings and transactions is an important attribute of an entrepreneur |

| Avoids and prevents Riba (financialization) | Muhammad (PBUH) as an entrepreneur didn’t practice Riba, and as Prophet and getting injunction in the Holy Quran, abolished Riba | Islamic finance has emerged as a response based on the guidelines of the Shari’a |

| Avoids and prevents Gambling | Muhammad (PBUH) similarly did not practice gambling and prohibited it | Significant implications for promoting genuine and real and mutually beneficial economic activities and transactions |

| Follows the middle path | Moderation and middle path in all pursuits of life, including consumption, guided innovations, dealings, and all social interactions | Moderation, tolerance, mutual respect, and empathy are important qualities of leadership and entrepreneurship and economic pursuits as opposed to greed and selfishness |

| Establishes Al- Meezan (universal balance) | Universal balance in all aspects of life including economy, society, ecology and passive stakeholders like other species and future generations | Al-Meezan is an important framework for an embedded society and therefore we further described it separately in Figure 4.10 |

| Prohibit Waste and Extravagance | Islam has strongly prohibited waste (Israf) and extravagance (Tabzeer) in the Quran and exemplified from the life of Prophet Muhammad (PBUH) | In contemporary context it has important implications for resource decoupling and efficient use and control on emissions |

| Establishes rights of passive stakeholders | Passive stakeholders are weaker segments of society, future generations, and other species. In the OS it is a pillar of the system framework | Has important implications for eliminating waste, emissions and preservation of the ecosystems which is the basis of healthy life. |

| Permissible and pure | Phrase used in the Holy Quran for consumption and use of materials | Has important implication for nature-based production and consumption and hence restoration and preservation of the ecosystems |

Nature-based impactful business criteria

Climate entrepreneur will develop and follow business criteria based on natural laws, also referred to as Nature Based Solution (NbS) in the NDCs. The key characteristics of these laws is zero-waste in the different life-sustaining and regenerating laws as pictured in Figure 4.12. CO2 emissions disturb these natural life-sustaining cycles. Injudicious and excessive extraction of

natural resources degrades the natural assets of ecological environment, biodiversity and carbon sequestering and storing on earth and reduces regenerative quality of soil. Financialization has a strong impetus in promoting carbon-intensive businesses and footprint on services. Keeping these and other related economic, social, governance and environmental concerns in view Khan and Badji (2020) developed impactful business criteria based on five pillars – a) zero-waste, b) zero- emissions, c) zero-riba, d) forbearance and f) service to society.

Open innovation and entrepreneurship mindset

Entrepreneurial clean creative destruction for climate remediation is the urgent need for an effective paradigm shift. Innovations, copyrights, and patents play a key role in incentivizing the entrepreneurial risk-taking. Ebrahim (2021) undertakes the classical preference for open knowledge sharing in the Islamic intellectual heritage and then offers a robust framework for patenting and protecting intellectual copyrights from the Islamic legal perspective. While agreeing with that conclusion of Ebrahim, there is an important justification to call for open entrepreneurship and open innovation based on sharing patents and copyrights. This type of sharing is overall consistent with the ethos of open knowledge sharing in Islamic intellectual heritage historically.

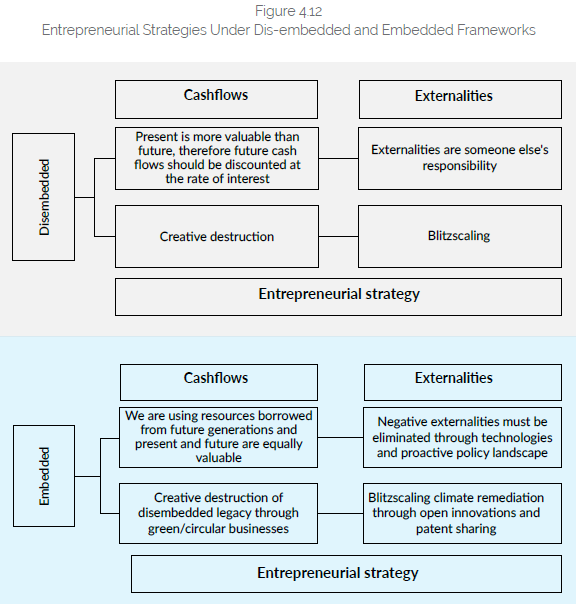

Indeed, conventional wisdom calls for entrepreneurs to have a strict secrecy policy about their contents, there is also a growing importance assigned to open innovation and entrepreneurship. In their discussion on Tesla’s open innovation policy, Furr and Dyer (2020) conclude that “Tesla has shifted the auto industry toward electric vehicles, achieved consistently growing revenues, and at the start of 2020 was the highest performing automaker, in terms of total return, sales growth and long-term shareholder value. As a technology and innovation scholar, the author has studied how innovators commercialize innovative technologies and found that Tesla’s strategy offers enduring lessons for any innovator, especially in terms of how to win support for an idea and how to bring recent technologies to market. To understand Tesla’s strategy, one must separate its two primary pillars: headline-grabbing moves like launching the Cybertruck or the Roadster 2.0 and the big bets it is making on its core vehicles, the models S, X, 3, and Y.” In fact, by its open innovation policy, Tesla is indeed blitz scaling (see more on this entrepreneurial terminology below) the transition to clean transportation and energy more widely. Figure 4.12 summarizes the creative destruction and blitz scaling strategies under dis-embedded and embedded frameworks. Obviously, strategies under the two frameworks juxtapose each other.

Savvy of technological disruption

The fourth industrial revolution is an age of cyber entrepreneurship where disruptions happen faster than expected in all areas. For example, we already have experienced the mobile phone disruption that wiped away so many dominant technologies and businesses. Uber and Airbnb are other examples that respectively disrupted hotel industry and transport industry. FinTech, DeFi and Crypto assets are more examples. Numerous similar disruptions are being expected responding to the decarbonization landscape globally. Examples are automated solar-powered transport as service (TaaS) geared by online sales and home deliveries, parking and traffic congestions in big urban centers and potential energy storage facilities of solar-powered vehicles for residential energy needs. Similar breakthrough and fast disruptive technologies are expected in food, manufacturing, built habitat, etc. The climate entrepreneur must be savvy of such disruptions for strategic positioning and sustainability.

Arbib and Seba (2020) present an analysis of major technological disruptions that are taking place and will lead to much sooner than expected transformations of unprecedented proportions. “Technological and business model convergences is expected to result in a 10x improvement in costs and capabilities of new technologies, disrupting transportation as soon as 2021. As a result, by 2030 95% of all US passenger miles traveled would be served by on-demand, autonomous, electric vehicles owned by fleets. We call the new business model Transportation-as-a-Service (TaaS). The impacts of TaaS include an 80% reduction in transportation energy demand, a 90% reduction in tailpipe emissions, US$1 trillion in household savings, and more than 200 million cars taken off American roads. Applying the same analysis and modeling to the industrial agriculture sector, we found that, due to rapid improvement in the cost and capabilities of technologies like precision fermentation, genome sequencing, and CRISPR, and a new model of production we call Food-as-Software, the cost of proteins would be 10x cheaper than existing animal proteins by 2035, while the number of cows in the U.S. would have fallen by 50% and the cattle farming industry would effectively be bankrupt by 2030.” Arbib and Saba (2020) p 8.

In the technological and business model convergences, the role of AI, real time access to bigdata, virtual reality (metaverse platforms), distributive ledger technologies, coupled by a rapidly changing and supportive policies and regulations change the entrepreneurial landscape. The successful ICE is expected to be a savvy of these disruptive technologies and the fast-changing opportunities.

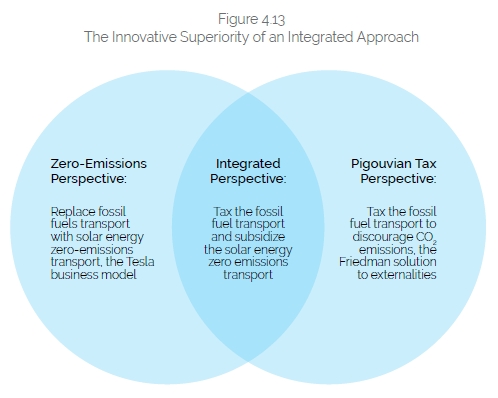

Integrated perspective

The climate entrepreneur can benefit from the dominant superiority of the integrated approach to strategic management in which the manager integrates the strengths of different and diverging perspective. As a good example, we can compare the different approaches adopted by the two iconic supporters of free markets in solving the problem of negative externalities of transport emissions – Milton Friedman an economist and Elon Musk. Friedman considered a Pigouvian Tax on emitters will discourage them from emitting. Musk produced the zero-emissions solar energy transport. In Figure 4.13 we picture an integrated solution where we combine the strengths of the two opposing perspectives; the tax revenues we can utilize to subsidize transition to the zero-emissions solution. The climate entrepreneur benefits from the flexible look at the available alternatives and innovate combining the strengths of the competing approaches. In the section on financial innovation, we discuss further flexibility within the universal framework of voluntary charity to overcome the limitations of the existence of the tax framework.

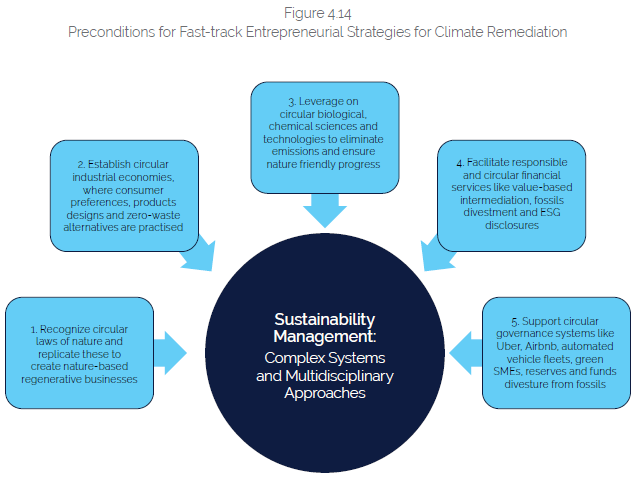

Preconditions for blitz scaling to remediate climate

Yeh and Hoffman (2018) call for a blitz scaling entrepreneurial strategy (a fast-track efficiency in maximising cashflows instead of service quality) as a success formula in the winners-take-all monopolistic market of platform economies

Like Schumpeterian narrative of creative destruction (CD), Yeh and Hoffman too have in view the dis-embedded economy as their frame of reference, where the future is discounted at the rate of interest, and the externalities are left as someone else’s concerns. However, like CD, the idea of blitz scaling is also relevant as entrepreneurial strategy for climate remediation and sustainability management (see Tesla’s blitz scaling through open innovation policy above). Success of an open innovation blitz scaling will require many institutional preconditions some of those are summarized in Figure 4.14.

- Circular laws of nature and regenerative systems: The most important laws of nature that make life possible on earth are water cycle, oxygen cycle, carbon cycle, photosynthesis, and regenerative food cycles. Science has learned from nature tremendously through biomimicry. Likewise, to establish a sustainable and resilient economic, social, and bio- spheric system in harmony with each other, economics, business, finance, management, and entrepreneurship needs also learn from nature.

- The industrial economies and supply chains, conforming to natural laws shall be regenerative, eliminating waste, and emissions and minimizing extraction of new resources. This can be achieved by non-toxic and durable and reusable design of products, by establishing industrial symbiosis and facilitating supply chains where one producing unit’s end-of-use material can be another industrial unit’s raw material. Indeed, emissions control requires green energy.

- Biology (by biodegradable packaging and regenerative plant-based agriculture), chemistry (by changing elements of materials) and physics (by breakthrough technologies like carbon capture recycling) – these are only examples; sciences can play pivotal role in ensuring climate remediation by focussing on zero-waste, zero-emissions, and ecosystems rehabilitation.

- Financial services have heavily contributed to climate change. “If the financial institutions (FIs) in this study were a country, they would have the fifth largest emissions in the world, falling just short of Russia. Financed emissions from the 18 institutions covered in this

- report are equivalent to 432 million passenger vehicles driven for one year. Financed emissions from the eight banks studied in this report are equivalent to 80 million homes’ energy use for one year. Financed emissions from the 10 asset managers studied in this report are equivalent to 3 billion barrels of oil consumed”. Cushing et., al (2021). Therefore, the responsible finance movement is playing critically important role in climate remediation finance. In this race to responsibility, to support the initiatives of the ICEs the Islamic commercial and social finance and regulators must play an important role. Some aspects of this point are further discussed below.

- A new global economy’s governance system is already taking over through platform economies, increasing use of every-thing-as-service models, sharing economies, AI driven EV fleets, metaverse, distributive governance, DeFi and DLT and crowdfunding distributive philanthropy etc., having immense implications for entrepreneurship.

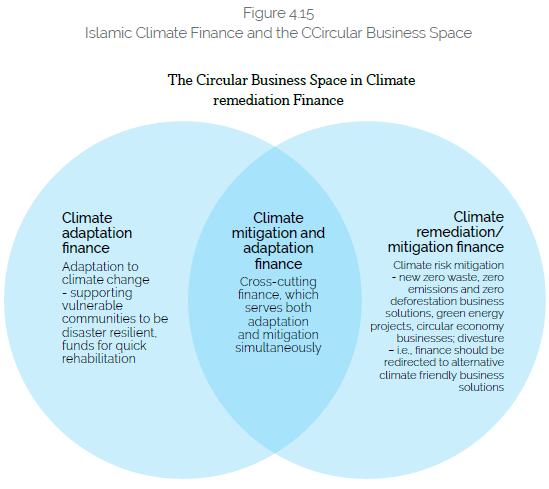

- Innovative Islamic Finance for Green Businesses

An unprecedented awareness about Anthropocene remediation has developed globally over the past few years. Governments’ legal and regulatory policies are changing, new disruptive green energies and food are being developed and businesses are racing towards responsibility. Entrepreneurs and financiers are finding new roles, visions, and missions. A consensus is emerging between civil society institutions and philanthropies, government agencies, businesses, and financial institutions that responsible businesses can capture and reverse global warming and restore the ecosystems. The scope of the emerging Islamic climate finance is summarized in Figure 4.13.

Such a consensus must also emerge among the stakeholders of the Islamic economy – social finance, commercial finance, and governments to work jointly to make responsible businesses successful. Responsible businesses can be simply described by Shari’a compliance, zero-waste, zero-emissions and services to society and diversity. Given such a consensus emerges, the following innovative financial instruments have the prospects to support entrepreneurs with green and clean visions for their businesses.

Purification of Carbon Impurity

In the present carbon economies, carbon emissions by individuals, households and firms are often unavoidable. Take the example of air travel or private and public transport for example, no matter what we do travel is unavoidable and causes emissions. As responsible citizens and businesses we need to minimize emissions of our decisions and acts. Despite best efforts whatever, unavoidable emissions may still exist, those can be offset by supporting zero-emissions small and medium businesses who face higher cost (green premiums) in doing their businesses. Information about certified green and circular businesses for which formal carbon credits are available are already emerging (see https://drawdown.org/solutions/table-of-solutions). The drawdown solutions (Hawken 2017) list contains over 80 project areas covering different sectors with

estimated CO2 reduction by each project. This is an example of the start of a new transformative entrepreneurial approach and with regulatory and civil society support the approach has the potential to become the mainstream.

Are emissions and waste considered impurities in the Shari’a? The question is not yet addressed in the Islamic finance literature in our knowledge. However, the OIC Fiqh Academy has a specially designated resolution for protecting the environment.

Whatever we do to reduce our waste and emissions as individuals, families, and businesses, we will always have to cause emissions like for example air travel, internal combustion vehicles, fossil fuels energy usage, consumption of meat and rice etc., are just unavoidable. Indeed, we have injunctions against waste, spreading hazard and requirements for protecting the environment. Indeed, new breakthrough technologies are reducing emissions and waste, we however, inevitably add to emissions and waste and pollute continuously. This pollution accumulates to our future generations, and therefore it is sort of an impurity.

Given these contemporary concerns of humans caused climate catastrophe (Anthropocene), we need to have better understanding of the Quranic injunction of halal and tayyib (permitted and pure). Given the overarching cross-generational need of cutting emissions and waste, these emissions and waste shall be considered as impurities and must be purified by making charitable contributions.

The cost-free measurement of waste and emissions is easily done by standard methods using computer applications for individuals, companies, and countries. There are already certifications for zero-waste and zero-emissions companies available. Using the existing technology, and measuring the ecological footprint of a transaction, contract or business, suitable amounts of charitable contributions can be calculated instantly. This contribution can then be diverted to those SMMEs that avoid waste and emissions as once they avoid waste and emissions, they may incur an additional cost of doing the business. The charitable contributions raised from carbon-impurity purification contributions will relieve some of the added cost of the zero waste and zero emissions SMMEs.

In a more formal setting using DLT and DeFi concepts and platforms once cleared by regulators, Carbon Cleansing Sukuk (CCS) can be issued. Those who want to purify the impact of their emissions can buy those Sukuk and the proceeds can be diverted to the beneficiary zero-carbon small businesses.

Relief from Corporate Distress – Too Good to Fail

During COVID-19, we noticed public authorities releasing unprecedented public funds to support small and medium businesses to prevent these from bankruptcy and closure. Moreover, during the 2007-9 global financial crisis we also noticed massive public bailout programs (helicopter money) for the private financial services. “Not letting a business to fail” strategy is also used by certain national business development finance institutions like, for example, the Qatar Development Bank. Not letting a business to fail is in public interest and is increasingly being used as the core strategy in bailout of financial institutions and other big companies.

A formal scheme for bailout of impactful SMMEs can be formulated as part of the financial contract between the financier and the user of finance. For example, if the contract is a murabaha, for a zero-waste, zero-emissions SMME, the murabaha contract could have an option of converting into declining musharaka for the financier, whenever there is a distress for genuine uncontrollable reasons. For example, the beneficiary SMME is unable to pay due installment of $2,000. To relieve the distress of the SMME, and to prevent it from closure, the financier can assume $2,000 ownership in lieu of the defaulted receivables. The conversion of the receivable into equity is such a case is discussed in the literature and it is Shari’a compatible. This way the SMME will avoid closure and have time for rehabilitation. Indeed, the financial institution in this case must have an impact investor mandate to make responsible businesses successful. This arrangement is discussed in more detail in (Khan 2019b) under integrating compassion in financial contracting.

Social Subsidy to Cover Green Premiums

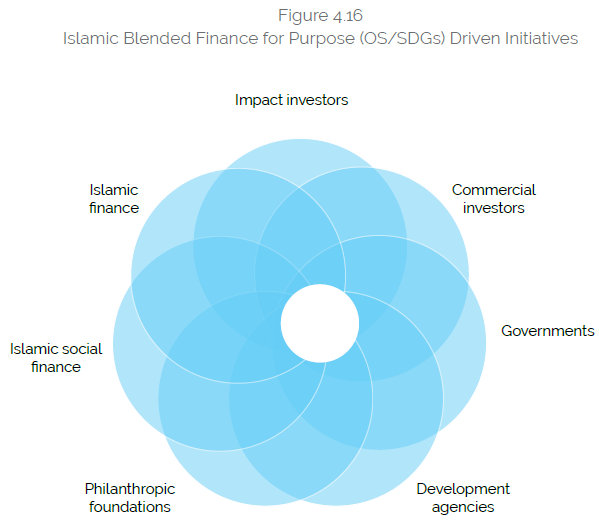

Carbon and waste-free SMMEs may face green premiums – additional cost for doing the business. But since such businesses are the center of consensus among different stakeholders of climate finance, those who agree will join if facilitated by governments to provide blended finance solutions. The stakeholders for potential blended finance solutions are identified in Figure 4.14.

Each stakeholder will participate in accordance with its own mandate. For example, charitable organizations will provide grants, donor agencies will provide free technical and guarantee services, commercial and impact investors will participate according to their mandates and government agencies will ensure the required facilitation.

This manner, the blended finance mechanism will also create a social subsidy against the green premiums. A formal discussion of this mechanism for impactful SMEs is available in (Khan and Badji 2020). Under Paris Agreement commitments countries are required to issue Nationally Determined Contributions (NDCs) to climate change. The commitments to CO reductions are classified as unconditional national commits and conditional commitments contingent upon the availability of international climate finance.

For example, in its latest NDCs Update 2021 (Pakistan 2021), the country is committed to 50% reduction in CO2 by 2030 (15% unconditional and 35% conditional). It is in this framework that with a proper policy support financial structuring the blended finance framework can create significant support for impact SMEs and climate entrepreneurs in all areas – green energy, low-cost housing, water and sanitation, afforestation and reforestation, health, education, SMEs etc.

To bailout the planet earth there’s a growing commitment to bailout climate friendly responsible businesses. There are numerous and growing commitments of divesture from carbon investments all over the world as voluntary responsible action as well as under different types of pressures including litigation.

One noticeable example is the $52 billion Harvard Endowment Fund announcing its divesture from fossil-based investments to avoid a legal injunction of breach of trustee responsibilities by investing in the fossil industry. In addition, “there are now 1,485 institutions publicly committed to at least some form of fossil divestment, representing an enormous $39.2 trillion of assets under management (Divest-Invest 2021). These examples represent an unprecedented transformation and unexpected fast disruption of carbon-intensive assets – indeed creating massive opportunities for climate entrepreneurship.

Conclusions and Implications

In this chapter we attempted to relate the role of entrepreneurs to the ongoing global discussions on the climate disaster and the transformation of policy landscape with an objective to remediate the climate and restore ecosystems through reforms of businesses, financial services, and improvement in technologies. We also tried to identify the role of an entrepreneur who is inspired by the various relevant Islamic attributes. An effort was made to highlight emerging circular/green business practices and prospects are some innovative Islamic financial instruments that can accommodate the need of the required business transformations. It was noted that the human civilization is going through the anthropogenic era as the human-initiated activities have more adverse influence on the earth’s biosphere as compared to natural factors. There is an urgent need to rethink the economic paradigm and the economic institutions including entrepreneurship that have caused the unprecedented climate change. The Schumpeterian institution of entrepreneurship and its narrative of creative destruction is one such important area that requires a revisit. Similarly, the popular contemporary entrepreneurial strategy of blitz scaling (fast-track entrepreneurship) is another relevant concept to reframe through the emerging open innovation alternatives.

Positive role of entrepreneurship for society’s well-being is well appreciated in Islamic economics as prior to his Prophethood, Muhammad (PBUH) was himself an entrepreneur. Therefore, the attributes of transformative Islamic entrepreneurs are also well recognized. This chapter argues that businesses have caused the climate change and therefore businesses must play a central role in climate remediation through innovation and cleaner creative destruction and blitz scaling. The attributes of the Islamic entrepreneurship have high relevance for aligning economic development, societal well-being, and ecological resilience as the preconditions of comprehensive development and the management of its sustainability. The chapter uses the embedded multidimensional development framework of OS and SDGs and sustainability management paradigm of circular businesses as an ecosystem for entrepreneurial initiatives. The chapter also discusses prospects and suggests some potential themes of innovative Islamic finance for promoting climate-friendly entrepreneurship.

Several implications of our study are worth noted. Green economic transformation, namely, achieving high and very high HDI within the capacity of one earth requires an unprecedented transformation of economies. In this the criterion for doing the business needs to be redefined to minimize and possibly eliminate negative externalities. The stakeholders including governments, philanthropies, commercial and social finance entities, and multilateral and development finance organization will need to work jointly. There is a race to responsibility in this regards and Islamic economics, finance and entrepreneurship must lead the race for being inherently responsible. Academic programs, curriculum and pedagogy and research and policy need the required redirection to meet the needs of new leadership competencies.