The Case of Ubaid Waqf Economy Model

It is an ardent desire of many Muslims to witness the realization of a true Islamic economy that is benevolent to the community. The growth and advancement of IsBF, within the present riba-based monetary system, is a step towards that vision. However, the success of the industry has not necessarily translated into uplifting society’s socio-economic standards. In addition, the current financial systems have rendered economies and the environment unsustainable. Therefore, the need arises to look beyond traditional financial institutions and economic models to seek a sustainable and equitable system that will benefit all community sections. Towards this end, this chapter proposes an innovative waqf economy model that is being practiced in South East Asia, which in our reasoning is capable of rendering that pristine Islamic economics and social system that is aspired.

Introduction

It is an aspiration for Muslims worldwide to realize a true Islamic economics and finance system in effect, at least in their respective countries. There have been several attempts at Islamic economic revivalism, a prominent example being the IsBF industry and Islamic insurance1 (Takaful). Though these industries have witnessed phenomenal growth globally, a true Islamic economy is yet to be actualized anywhere that can be emulated. Muslim countries are still tagged as developing nations and third world nations with their economies based on riba, face a myriad of problems from rising inflation, the rising cost of living, high levels of illiteracy, unemployment, poverty, and widening gap in wealth distribution. Moreover, their involvement in research and development in science, or any other field, is relatively minimal.

As a result, creativity and innovation are not fostered within their economies, leading to few products conceived and manufactured in Muslim countries worthy of emulation. In addition, there is also little evidence that the IsBF industry has made any significant contribution to the development of Muslim nations and improved the lives of Muslims.

Scholars have pointed out that a root cause for the aforementioned socioeconomic problems are the current monetary and financial system. Political subversion by stronger Western nations are also a contributing factor, with many Muslim nations being remnants of former Western colonization. It may be argued that the developed Western countries also have the same riba-based financial system in place, however their superiority stems from the wealth derived from their former colonies, allowing them a head-start in economic development and scientific research, couple with the fact that the current riba-based fiat monetary system is designed towards an unjust transfer of wealth.

Per contra, Muslims are proud to conceive a relatively stable banking and finance system compared to the conventional ones, the capitalistic mindset prevails in all, resulting in the observances of similar problems across all countries such as rising inflation, the rising cost of living, growing disparity in wealth and income distribution, persistent poverty, unaffordable housing and destruction to the environment.

Today, the world faces a gargantuan crisis caused by the COVID-19 pandemic that has affected every stratum of society globally. The remedial lockdowns and restricted cross-border travel have caused many economies to shrink, dealing a big blow to many livelihoods and disrupting all spheres of public and private lives.

The recessionary effects of COVID-19 are yet to be ascertained, though inevitable. As such, solutions must be sought beyond the realms of traditional financial institutions. With the growing prominence of social finance, this chapter will shed some light on how a traditional Islamic finance concept can be a sustainable, ethical alternative and multiplier effect on a community’s socio-economic condition.

Problem statement

Despite the abundance of waqf properties lying idle without any productive revenue generation, there continue to be more waqf assets being endowed, contributing to the existing underutilized stock. These issues occur when there are many different bodies, both private and public, that manage waqf and when beneficiaries are too varied. In addition, waqf is primarily perceived as a primitive practice with purely religious connotations and not as a tool for socio-economic development.

It is essential that a proper economic solution that integrates both is designed for the optimal allocation and utilization of waqf assets to contribute to the overall sustainable human and economic development.

Research Objective

The main objective of this chapter is to explore the case of The Ubaid Waqf Economy Model as an initiative that contributes to sustainable human and socio-economic development. The waqf model currently being implemented in South East Asia can potentially assist Muslims in materializing that long dream of realizing a true Islamic economic and financial system. This model is the brainchild of Dato’ Abu Ubaidah Kemin, a businessman who conceptualized this model and now aspires to expand it globally. In the following sections, the overall structure of the model, hereafter referred to as Ubaid Waqf Economy Model (UWEM), will be described and discussed, with particular emphasis on how waqf can potentially lead to a true Islamic economic system.

Literature Review

The term waqf refers to the “allotment and preservation of a property for a specified benefit and the prohibition of using it for anything outside its stipulated objective”. In Arabic, its root word means “to prevent or restrain, confinement and detention” and entails permanent endowment for a specific purpose that is usually religious or charitable. It is also defined as the “investment of funds and other assets in creative properties that provide either usufruct or revenues for future consumption by individuals or groups of individuals”. The proceeds and use of waqf assets must be employed and invested in a permissible manner in Islam and should not go against religious teachings. Though waqf may come in many different forms and categories, it is imperative that the beneficiaries be specified with criteria and conditions.

Currently, there is renewed interest in waqf and its role in Islamic social finance for functions beyond the realms of traditional financial institutions. A plethora of studies exist that both have hailed its concept, yet rued its inefficient utilization16. As an example, it is reported that Indonesia alone has about 1,400 square kilometers of waqf land with an estimated value of US$60 billion. If these lands were put to productive use efficiently and earned a conservative return of 5% per annum, the potential returns would be about US$3 billion, which can be used to finance many socio-economic endeavors and initiatives.

Indonesia alone has about 1,400 square kilometres of waqf land with an estimated value of US$60 billion

In addition, waqf transcends the traditional immovable asset forms such as lands, mosques, and schools, and modern applications include providing health services, drinking water and construction of wells, education programs, and poverty alleviation and social entrepreneurship initiatives.

On a fiscal level, it has been found that the higher average per capita income in Muslim countries does not lead to higher socio-economic well-being within respective economies, hence the need for a more effective social and financial intermediation. Most of the waqf administration is handled by the state or state bodies (Ab Hasan et al., 2015). For example, in Malaysia, waqf is managed by the State Islamic Religious Council of each state, and in Brunei by the Majlis Ugama Islam Brunei administers all waqf property. The incumbent issues of waqf administration of existing bodies have been highly researched, and there is a strong call for better governance and management of waqf assets, for both publicly and privately managed. There is also a call for “third sector economy,” or the voluntary sector, to be involved within the waqf sector, citing the possible unsustainability of public and private models.

Towards this end, several initiatives innovatively employ waqf as a means for socio-economic development, each with its scale, unique traits, and challenges. A famous example is cash waqf, which can be broadly defined as “a benevolent endowment fund formed with cash corpus, which is permanently dedicated to charitable activities and privately owned by a Muslim, or a group of Muslims, or a corporate body governed according to Shari’a with perpetual dedication of its usufruct to be spent on any purpose recognized by Shari’a”. Cash waqf has become a popular alternative due to its ease of liquidity, management, distribution, and subscription compared to other waqf assets. Bakar et al. (2019) provide a model of a corporate waqf university with insights on its management. Raheem (2021) posits a national waqf model that can be used to fund universal basic income. Khan et al. (2019) propose a waqf cooperative housing model as a solution towards the provision of affordable housing, financed by cash waqf, waqf sukuk and revenue generation from common waqf areas.

Other initiatives include waqf forests, development using blockchain technology, sukuk waqf, and Islamic waqf bank25. As there are many innovative proposals, one such initiative was launched and implemented in Malaysia, the Ubaid Waqf Economic Model (UWEM). This modus operandi of the UWEM will be the crux of this chapter.

Methodology

In this chapter, the Ubaid Waqf Economy Model (UWEM) and its implementation is described and evaluated as a case study. The case of UWEM is unique as it stems from an individuals’ desire to employ waqf for a common socioeconomic benefit. The objectives of its conception are identified, and the modus operandi are examined and evaluated accordingly for effectiveness and sustainability.

The Ubaid Waqf Economy Model (UWEM)

The Ubaid Waqf Economy Model (UWEM), a brainchild of businessman Dato Abu Ubaidah Kemin, was first launched in Johor, Malaysia, in 2015. In the early days, he would allocate 10% of net profits from his business ventures for the sake of waqf. Once an asset is bequeathed as waqf, then it cannot be sold or inherited. Instead, it becomes umma’s property for the benefit of umma.

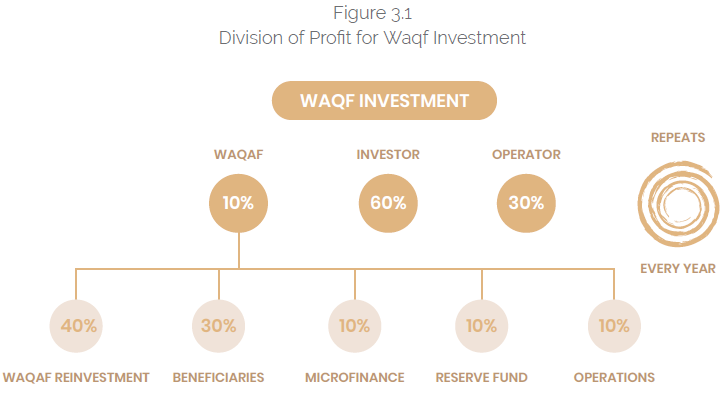

As his businesses grew, funds were invested in businesses operated by other trusted parties, on mudaraba or musharaka basis, who are willing to allocate 10% of net profits for waqf. Under this arrangement, the operator takes 30% of profits while Dato’ as investor is entitled to 60% of profits, with the remaining 10% of profits being channeled for waqf. This is illustrated in Figure 3.1 below.

Under this model as illustrated in Figure 3.1, waqf funds are apportioned from the net profits earned by business activities. From the waqf portions, 40% of the proceeds are reinvested into businesses, 30% are channeled to beneficiaries such as tahfeez schools and orphanages, 10% are utilized to provide qard hasan Microfinancing to small traders and individuals in need of short-term liquidity, 10% kept as Reserve Fund for contingencies, while the remaining 10% goes for the management and operations of the waqf.

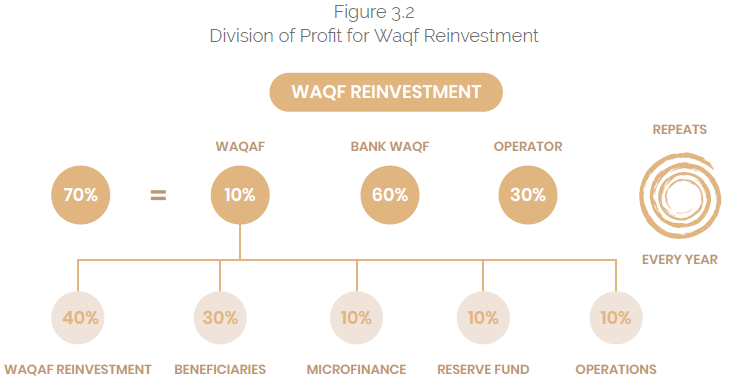

When the waqf funds are reinvested into business activities, the model stipulates 70% of the arising net profits to go back to the fund, whereas the operator is entitled to the remaining 30%. Out of the 70%, 60% will be apportioned to BankWaqf, an entity whose function will be described in the subsequent paragraphs, and 10% will be set aside as waqf. The waqf reinvestment and profit disbursement as described in Figure 3.2.

The reserve fund, which avails 10% of the waqf distribution, is created for contingency purposes during unexpected events. This reserve fund is an integral part of the UWEM and provides stability to the whole structure, and minimizes the need to borrow funds for liquidity purposes. However, cash is not kept idle in the reserve fund; rather, strategic asset allocation practices entail that 40% is invested in land and properties that bring about rental income, 20% is invested in gold which is a high-quality liquid asset with a potential for price appreciation and a hedge against inflation, and the remaining 40% is maintained as cash and shares. This strategy enables optimization of the reserve fund, with the ability to liquidate whenever there is a need for funds.

The repeated reinvestment of waqf funds with a 70% stake in the profits gave rise to a compounding effect that resulted in both the waqf funds and the ventures invested in growing exponentially, inspiring many to follow the UWEM business model. However, as the fund grew, it became difficult for a single person to manage. Thus the founder Dato’ Abu Ubaidah Kemin decided to merge this fund with the waqf funds of those who followed his UWEM model, hence enabling a much larger pooled Waqf Fund that can be used for empowering Muslim businesses and waqf beneficiaries in a much stronger way that can take advantage of economy of scale with greater bargaining power. With the ambition of taking this venture internationally, Dato’ Abu Ubaidah Kemin established the BankWaqf International in Indonesia and became its founding President.

The Bank Waqf International (BWI)

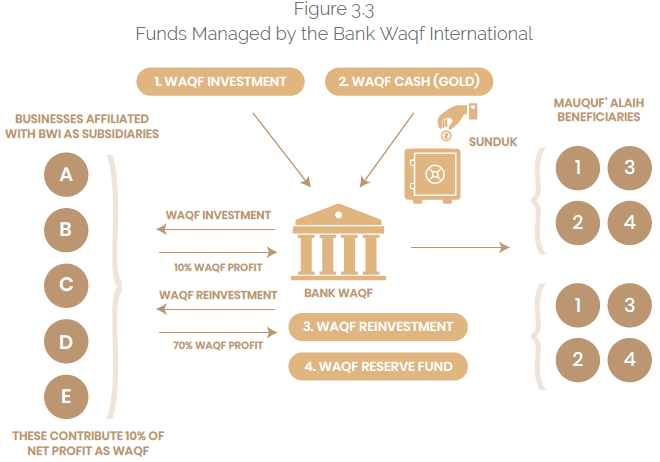

The Bank Waqf International (BWI) was established with the primary objective of aggregating all waqf contributions of businesses under one body. The businesses mentioned above themselves become the affiliated subsidiaries of the BWI. The BWI pools and manages four types of funds, namely Waqf Investment, Sunduq Waqf, i.e., cash waqf contributions by the public, corporations, organizations, government agencies, Waqf Reinvestment, and Waqf Reserve Fund. These funds are illustrated in Figure 3.3.

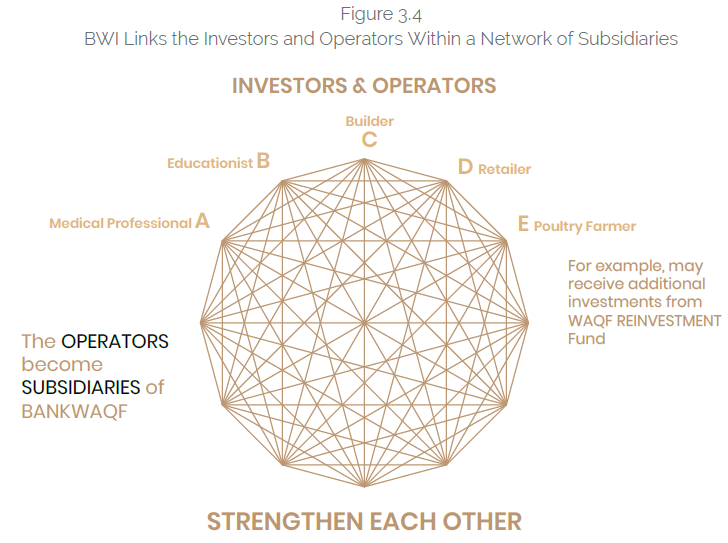

All the funds within are waqf in nature, making BWI acting like “trust fund” established to provide financial services to the people in the name of Allah SWT. Waqf is contributed to BWI in the form of cash or gold with the intention that these are invested in productive projects, and that the returns from these investments be then utilized for the benefit of the mauquf ‘alaih, i.e. the beneficiaries. The BWI therefore gathers and creates a network of business operators under its ambit of waqf and strengthens them into a “force to be reckoned with”. This is depicted in Figure 3.4 below.

In order to illustrate the system, let us assume that five business operators come under the BWI as affiliated subsidiaries; a medical professional, an educationist, a builder, a retailer, and a poultry farmer, as shown in Figure 3.4. All five business operators would contribute 10% of their net profits for the Waqf Fund. In addition, waqf investments received from the public could also be invested in these businesses if a business fulfills the criteria for investment. These businesses may also be eligible for waqf reinvestment funds. The BWI can also extend financing from the waqf reinvestment funds for business expansion of their operators or for new start-up entrepreneurs whose businesses are Shari’a-compliant.

Being in line with the Islamic laws and teachings and not involving anything prohibited in Islam, the BWI serves to be a global trust fund that belongs to the umma and is funded by the umma for the benefit and empowerment of the umma. One salient feature of BWI operations is that it backs its operations with gold. Currently, the operations of UWEM are both cash and gold-based, with the latter being an innovative solution. However, as mentioned earlier, BWI is fundamentally structured as a “trust” bank. The closest equivalent to waqf in conventional finance is the English trust. However, a trust can be set up for any objective, whereas waqf is charitable. That receives waqf in the form of cash which is then invested in productive businesses, and the returns are then distributed to the beneficiaries in the most beneficial ways. However, BWI also backs its operations with gold. The main reasons why a gold-based system is employed are described as follows.

Gold has shown to preserve value for thousands of years, and evidence has shown that the price of commodities relative to gold is practically a constant, a feat that fiat money cannot claim. One significant characteristic of a fiat money system is inflation, through which businesses lose significant wealth. In the current global recessionary economic situation, where nations are printing money in trillions of dollars in the name of quantitative easing to mitigate the economic effects of the COVID-19 pandemic, economies are vulnerable. Markets, primarily financial and real estate markets, can potentially collapse, and geopolitical tensions rise. In such scenarios, the value of gold would rise while the value of fiat currencies would fall.

As such, BWI backs its operations with gold to preserve its value of money holdings and investment. Moreover, the gold price in US dollars or national currencies is expected to rise in current times for the unforeseeable future due to the global geopolitical situation. Hence it is financially prudent to hold liquid assets in the form of gold over cash. Therefore a small portion of the waqf fund is kept liquid in a gold form, while the rest is invested in productive businesses, the returns of which are available for the beneficiaries. In the Malaysian case of Waqf Investment, the cash invested by the investors would be immediately turned into gold. This gold would then be placed as collateral with a partner bank, using the rahn concept, and receive 80% of the money for investment purposes. This way, 20% of the funds are held in gold, while 100% belong to BWI. As the value of gold rises as expected, the value of the gold holdings will also rise.

This way, people can also give gold as waqf (permanent or temporary) as Waqf Investment or Waqf Gold (like cash waqf). Together with the gold custodian banks and BWI, the state’s religious authority would act as the trustees of the gold, which belongs to the umma. In order to provide integrity and confidence of the public in the whole waqf in the economic system, BWI manages the funds using trustees who adhere to transparency and good governance and adhere to AAOIFI’s waqf guidelines.

Adoption of Good Governance and Practices

The UWEM adopts and maintains good management practices, as it is a “trustee” for wealth given in the name of Allah SWT. Therefore, the following measures are adopted for purposes of governance and management:

- Business Advisory Unit – this unit is set up within BWI to provide continuous advisory for any problems the member subsidiary companies might face.

- Digitalization of business – Members are trained in business administration and digitalization to keep their business modern, up-to-date, and with applications of IT for management, accounting, finance, marketing, human resource management, and inventory management. This also facilitates transparency and governance.

- The waqf employs investment appraisal officers to evaluate investment applications relatively in a just and professional manner. In addition, relationships officers are also placed as part of the management team of the micro-enterprises, particularly to monitor their running of the business and to be co-signatories for payments issued from the provided fund.

The Socio-Economic Benefits of Ubaid Waqf Economy Model

Any system designed and focused on sustainable growth must consider the “non-financial aspects” of the economy, such as social well-being, human capital, and the environment. If established on a large scale, the UWEM aims to reverse persistent inflation, widening wealth distribution and income disparity, poverty, illiteracy, and high levels of corruption that may occur within the current capitalistic system. The following passages will further elaborate on the projected socio-economic benefits of UWEM.

The UWEM is an exemplary model of how the community can uplift each other. As the waqf fund grows exponentially and funds are invested and reinvested in businesses, it helps create jobs and provide employment, empowering people. History has shown how the waqf sector has catered for education and health, and hence the UWEM can impact human development directly and indirectly through education, training, and skill-building. The UWEM enables and facilitates economic networks such as food, shelter, health, education, utilities, transportation and communication with greater ease, enhancing living standards across the community.

For example, the UWEM provides a means to finance education and scientific research and development generously. This can significantly enhance the human capital in the economy and reward teachers and trainers their deserved wages.

From a monetary point of view, the UWEM finances business activities without creating new money, contrary to the present conventional and Islamic banking systems, and hence will not contribute to (the monetary cause of) inflation, the rising cost of living, unaffordable homes, and environmental destruction. Studies have suggested that money is the missing link for sustainability. To uphold this, the UWEM backs its investments and economic activities with gold.

From an economic standpoint, the UWEM provides riba-free (or interest-free) financing for new and existing essential businesses to grow and household consumption. It therefore promotes and enables the whole system to be free from riba. Moreover, through its redistribution channels, the UWEM can also contribute to social justice and reversing income and wealth inequalities in the economy. The socio-economic benefits of an improved standard of living are manifold. On the individual level, jobs and employment provide a strong sense of self-worth, reduce stress, and improve mental and physical health. On a macro level, this can reduce public expenditure for healthcare in the long run. With access to economic networks guaranteed for everyone, waqf can indeed provide social security for all.

The “by Umma for Umma” approach makes people become an asset to each other. This creates social wealth, i.e., peace, harmony, compassion, love, and tolerance to prevail in the economy. Accordingly, it gives birth to a compassionate gift economy rather than a mere competitive profit-motivated economy as in today’s economic systems. In other words, the UWEM helps transform the umma into an “upper-hand” society rather than an always aid-requesting “lower-hand” people. As such, it alters the criteria of social success and hierarchy from wealth accumulation to wealth gives. Ultimately, it provides a path for the attainment of United Nations Sustainable Development Goals (SDGs).

Unique Features of Waqf as an Institutional Tool in Islamic Economics

Waqf Versus Tax

Waqf is often compared with tax. Tax indeed is a burden to people as it takes away more from their disposable income, which is why many try to evade its payment. Certain countries have exorbitantly high tax rates, and taxes can also contribute towards inflation and rising cost of living. Waqf on the other hand is voluntary and doesn’t burden the giver as it is bequeathed for the sake of Allah’s pleasure. Therefore, waqf is a superior way to finance public projects compared to financing using tax, as waqf encourages financing of public utilities, amenities and infrastructure. Also, just like tax, waqf can be contributed by non-Muslims and they can also enjoy its benefits.

Waqf and Zakat can Keeps the System Debt-Free

Zakat takes care of the eight asnaf, i.e., eligible recipients of zakat, among whom are the miskeen (poor), faqeer (the hard-core poor), and those in debt and unable to settle it. While zakat takes care of these people in destitute, waqf, on the other hand, can further empower them with education, skill-building, and financing. Therefore together, both zakat and waqf keep the system debt-free, with a safety net that prevents bankruptcy for anyone – household or business –when the system works at its total efficiency.

Provision of a Supplementary Income for Everyone

The UWEM aspires to provide a second income for everyone, particularly for the lower-income group like farmers and fishers, using funds from the Sunduq Waqf, zakat (in this case meant only for the ansaf), sadaqa . Alternatively, even government subsidies, the system aspires to provide mainly the poor, like the B40 group, shares in the downstream businesses where these people work and contribute. Thus, for example, farmworkers could be given shares in food processing plants, and fishers could be given shares in businesses that process fish products. In this way, the poor can avail themselves of a secondary income similar to the Universal Basic Income (UBI) concept gaining traction in many countries. Thus, the structure of the BWI provides second income for all, including investors.

Waqf Assists in the Attainment of Maqasid al-Shari’a

Waqf protects life by providing social security for all; protects faith, intellect, and progeny by providing education, health, financing, and overall security; and protects wealth by countering riba; providing everyone with a second income and makes it easy for everyone to access the economic networks.

Conclusion

The UWEM is an innovative, viable, and sustainable step towards a gold-backed waqf economy, presenting an opportunity to realize the pristine Islamic economics, finance, and social system visualized and desired at the onset of Islamic revivalism in the early 1970s. Despite the advancement of the Islamic banking industry and halal industry globally, the impact of their growths has been minimal on the overall well-being of Muslims throughout the world. The gold-backed Ubaid Waqf Economy Model (UWEM) aspires to provide a unique path for Muslims to achieve that long-desired goal of realizing true Islamic economics, finance, and social order. It is an ardent desire of the founder that the UWEM gain a wider exposure amongst governments, policymakers and academics to inspire and revive the institution of waqf towards sustainably rejuvenating the economy.