Reframing Islamic Finance Architecture and Infrastructures

Introduction

It is widely recognized that the earth, human civilization, and other species are currently going through the epoch of Anthropocene, i.e., the biocapacity of the earth is adversely being impacted by human actions, far more in intensity than the natural factors (IPCC August 2021). CO2 emissions and the rezsultant global warming primarily cause this catastrophe. It has been recognized for at least two decades now and has been the factor behind the United Nations Framework Convention on Climate Change known as the Kyoto Protocol 1992 and the Paris Agreement 2015 to remediate climate by reducing CO2 emissions.

Islamic economics and finance principles are inspired by the teachings of Islam, which are also shared by all religions. The core principles include:

- Mankind being a trustee of Allah on earth must look after earth with great responsibility;

- As a trustee of Allah mankind shall establish al-Meezan (the universal balance);

- Israaf (waste) and Tabzeer (extravagances) are strictly discouraged;

- Balanced approach of lifestyle (wassatiya) is highly encouraged;

- Riba (commercialization and financialization of lending) is strictly prohibited;

- A multidimensional Maqasid framework for strategies and policy landscape is provided; and

- A moral (Shari’a) screening to be voluntarily adopted by financial institutions and other businesses as an integral part of the governance system.

These principles are indeed in coherence with the emerging transformative reforms towards greater responsibilities. However, in practice, Islamic finance must operate within the existing international financial, legal, regulatory, supervisory, and disclosure framework. The standards of Basel Committee for Banking Supervision (BCBS), adapted for Islamic finance by the Islamic Financial Services Board (IFSB), and the standards of International Accounting Standards Board (IASB) adapted for Islamic finance by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) are only two essential examples. The standards of IFSB and AAOIFI have been instrumental in establishing the international credibility of Islamic finance.

This important chapter aims to assess the emerging transformative international policy landscape for the remediation of global warming and the changing role of Islamic financial architecture and infrastructures. Without the policy guidance and support from standard setters, regulators, and supervisors, Islamic finance may lag in the race towards responsible and sustainable finance. Lagging in the competition for sustainability by itself poses the most important reputational risk to the dynamism, resilience, and sustainability of Islamic finance.

“Without the policy guidance and support from standard setters, regulators, and supervisors, Islamic finance may lag in the race towards responsible and sustainable finance.”

In section one we have discussed the emergence of “climate policy failure” as the most critical risk to the global economy. We also describe the different climate policy scenarios.

In section two we have contextualized our discussion concerning SDGs and shows the divergence between human development and ecological footprint as policy targets. We show what it means to realign these two diverging policy targets and the unprecedented challenge of the targeted green economic transformation (GET) where high HDI is achieved within the capacity of one earth. We also outline the likely green economy circular business models that will eventually replace the existing linear business models. In section three we have summarized the transformations of the international financial architecture to achieve the targeted GET. In section four we have undertaken an initial gap analysis of the Islamic financial architecture and infrastructure to meet the challenges and opportunities of the green transformation. Finally, section give concludes and suggests policy implications of our analysis.

Top Risks Facing Global Economy and Climate Policy Scenarios

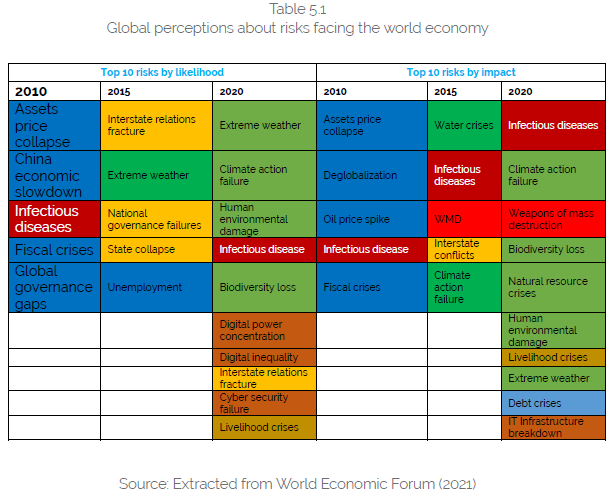

During the last two years, the overall perception of the global economy’s overriding risks has drastically changed. The pandemic, climate change, and digital revolution have entirely transformed the world and our perceptions of the world economy’s challenges. Global Risk Report 2021 reports the results of a comprehensive global risk perceptions survey. The results of risks likely to happen and risks perceived to impact the global economy are summarized in Table 5.1. We can see that climate-related risks are perceived to be the most serious. We also notice the overwhelming perception regarding the pandemic and uncertainties related to technology and the digital divide.

Table 5.1 also depicts the emergence of likely risks and their intensity over the last decade. It is pertinent to note that risks from economic origins (in blue color) were perceived to be dominant in the first half of the decade. However, in the second half of the decade, especially from 2018, risks from the environmental origins (in green color) are perceived to be dominant both in likelihood and intensity. We also see risks originating from digitization rising.

It is essential to note that risks originating from economic origins have not been reduced; instead, COVID-19 has led to an increase in extreme poverty, inequalities, accumulation of debt conditions in the least developed countries, and vaccine inequities.

It is ironic indeed that livelihood and debt crises, which remain acute, have gone down to the bottom in intensity and impact. The world is now predominantly overwhelmed by the climate crisis. The rising socio-economic problems because of environmental crises can be an additional devastating risk.

The UN Intergovernmental Panel on Climate Change (IPCC August 2021) validates this rapidly emerging perception about climate catastrophe. As a result of this science-based reality concerning the anticipated climate disaster, the global policy landscapes about climate risk mitigation and adaptation and regulation of financial services are changing rapidly.

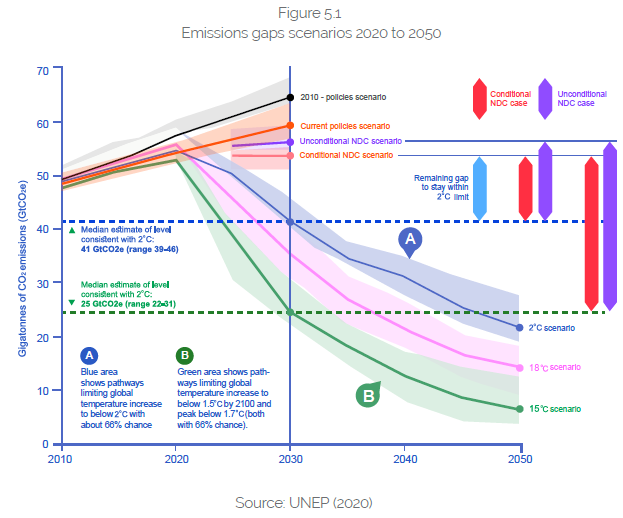

The IPCC reports confirm other scientific studies concerning natural capital risks – emissions, waste, and biodiversity loss. The findings of the 2020 Emissions Gaps Report by the UN Environmental Program are summarized in Figure 5.1. The black line shows the actual trend of global emissions, and the targeted Paris Agreement (scenario 1.5C global warming over the pre-industrial temperatures) emissions are shown by the green line.

The risks identified in Table 5.1 are related to the world remaining on the business-as-usual scenario of the policy landscape, which is perceived to be disastrous. The Paris Agreement Scenario of 1.5C by 2050 requires to reduce global annual emissions from 55 Gigatons in 2020 to less than 10 Gigatons in 2050. This requires a drastically different policy landscape, which is indeed fast emerging. Not achieving these targets (climate action failure) is perceived to be one of the top risks identified in Table 5.1.

SDGs and Climate Remediation

The UN Sustainable Development Goals (SDGs) have made climate crises part of the global development policy landscape. Suggesting climate crisis as a global risk has been an essential success of the SDGs. It is pertinent to note that the UN will celebrate the next ten years as the Ecosystems Restoration Decade. Ten years are left for the fulfilment of the goals delineated in SDGs. (2015-2030).

The SDG17 calls for coordinated efforts by the stakeholders to achieve the SDGs. The rest of the 16 SDGs concerns two overarching global policies that have historically been divergent due to wrong policy prescriptions. These are:

- the UN Human Development Index (HDI), which provides a framework for multidimensional development: and

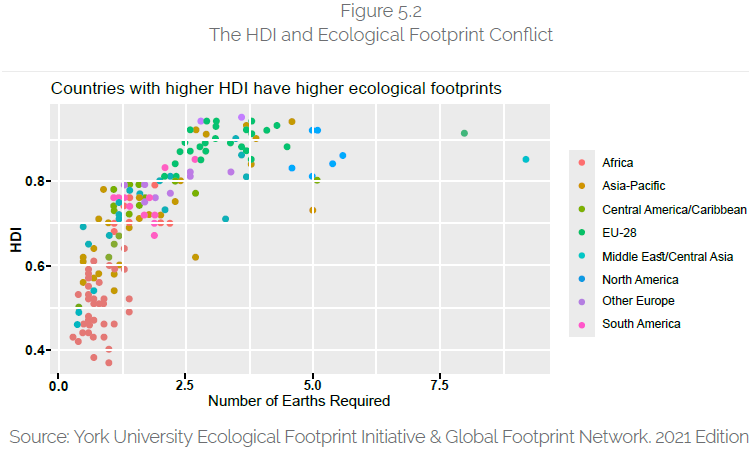

- Ecological Footprint Indicators (EF)1. The HDI from 0.8 to 1.0 is considered the highest target for any country. All developed and some emerging countries like Malaysia and GCC region, for example, have achieved this high level of HDI. On the other hand, the least developed countries have HDI lesser than 0.5. Pakistan’s HDI, for example, is slightly higher at 0.557.

The ecological footprint (EF) measures a country’s environmental resilience within the ecological system. Unfortunately, the EF of all the developed and emerging countries is much more than what is safely allowed. On the other hand, the EF of the least developed and developing countries is generally low. Pakistan’s EF, for example, is at 0.79, lower than its one-earth capacity.

Figure 5.2 summarizes the HDI and EF data for different countries worldwide, signifying this divergence between HDI and EF. Developed and emerging countries have achieved their respective high HDI at the cost of depleting the global public asset – the earth’s ecological capacity, because of waste-driven growth policies, the material footprint of resource extraction, CO2 emissions, deforestation, and climate change.

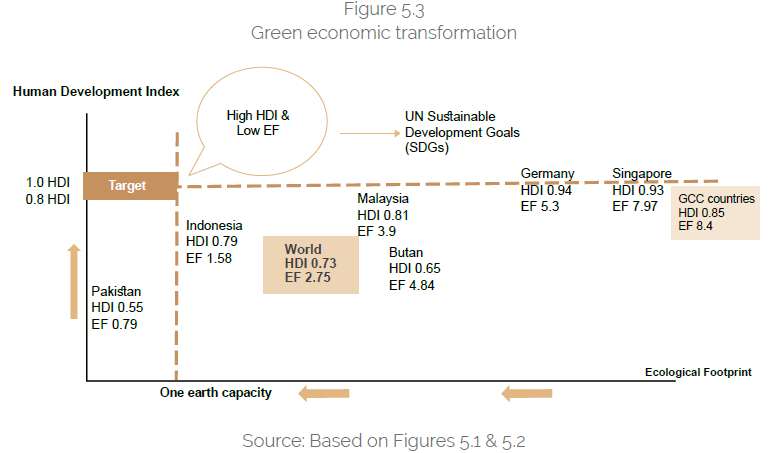

SDGs related to eliminating poverty, hunger, and disease could not be achieved if the quality of water and air is not safe. Similarly, even if poverty is eliminated, but waste is not managed, it would affect the quality and biodiversity of surface and seawater. Without a healthy planet, a healthy population is unattainable. Therefore, the new policy landscape should target the achievement of all SDGs – with the result to have high HDI within the capacity of one earth as pictured in Figure 5.3. We captioned the figure “green economic transformation” (GET), implying that developed countries must drastically reduce their ecological footprint while maintaining their high HDI level. Developing and least-developed countries must enhance their HDIs but without worsening their ecological footprint.

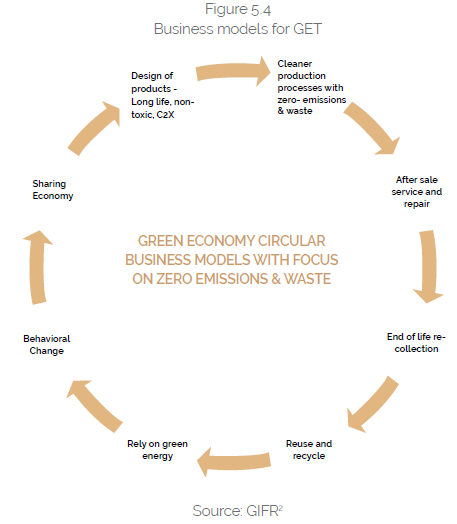

GET will require a new economic paradigm and drastic transformation of the economies to reduce emissions, eliminate waste, restore the ecosystems, and, for short, “heal ecology through the economy” with restorative, regenerative, and redistributive systems as summarized in Figure 5.4. The essential elements of the new paradigm are to internalize negative externalities through an altruistic change at the individuals, households, firms, and public sector organizations level concerning:

- Behavioural change in support of ecology and environment

- Reliance on green energy and zero-emissions

- Sharing economy solutions

- Breakthrough technologies and design of products, long-life non-toxic and cradle-to-cradle

- Green production processes with a focus on zero-waste and zero-emissions

- After-sale service and repair

- Product as a service and after-use recollection

- Reuse and recycle

Initiatives like the European Green Deal and similar national and municipal initiatives pursue the restorative and regenerative paradigm shift. It is also supported by restoring the ecosystems through reforestation, cleaning up rivers, seas, and oceans, and reducing emissions and waste. Thus, the green transformation is expected to reduce ecological footprints while enhancing the human development and well-being of future generations and other species.

Islamic Finance in the Emerging Global Financial Architecture and Policy Landscape

The international financial infrastructure comprises five pillars:

- Universal Moral, ethical, and legal norms and practices of conducting business;

- Best practice standards (capital adequacy, financial reporting and transparency, governance, supervision, etc;

- Objectives of financial infrastructure – Financial Development and Financial Stability;

- International institutions and their functional coordination – Financial Stability Board (FSB), BCBS, International Monetary Fund (IMF) World Bank (WB), etc; and

- Assessment of national financial infrastructures (financial sector assessment).

It is pertinent to note that all these pillars are undergoing profound and fast transformations.

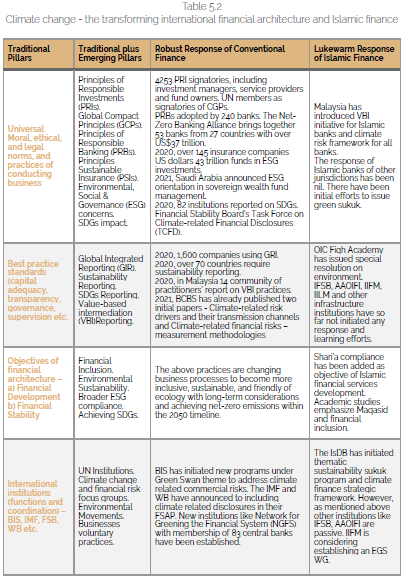

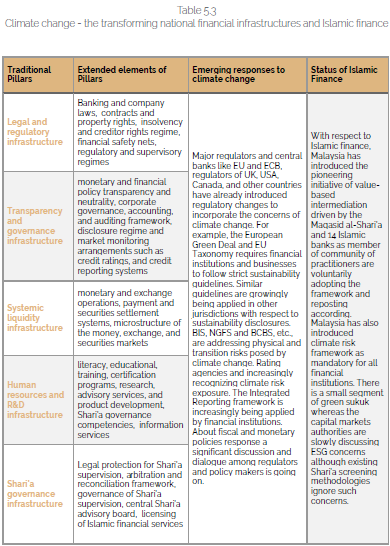

Table 5.2 summarizes these pillars and the transformation that is taking place.

Robust national support institutions are a prerequisite for the implementation of international best practices in local jurisdictions. The national financial infrastructures comprise several essential components:

- Legal and regulatory infrastructure;

- Financial reporting, transparency and governance infrastructure;

- Systemic liquidity infrastructure;

- Human resources, R&D financial innovation infrastructure (and for Islamic finance); and

- Shari’a governance infrastructure.

Due to the transformation of international architecture, these infrastructures are updated to provide the necessary support for the orderly transformation of economies and financial systems. Table 5.3 provides a summary of the national financial infrastructure to ensure the implementation of the international financial architecture.

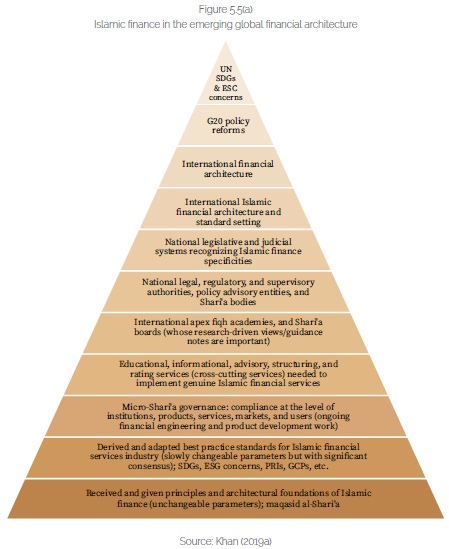

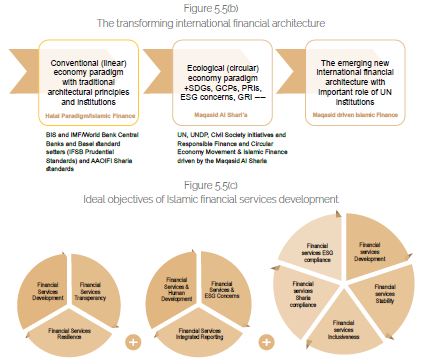

Together, the architecture and the infrastructures provide the overall policy landscape and regulatory and supervisory support for the conduct of financial services in an orderly, resilient, inclusive, and sustainable manner. The architecture and infrastructures of Islamic finance are a sub-set of the global system and cannot remain isolated. In Figure 5.6, we summarize this fact to highlight the interdependence and interlinkages of the Islamic finance architecture and infrastructure with the existing and emerging global systems.

1. Islamic finance in the transforming global financial architecture

The international financial architecture is transforming rapidly to meet the preconditions of GET explained in Figures 5.3 and 5.4. Table 5.2 and Figures 5.5 (a, b and c) explain this transformation and the influence of new institutions on reshaping the architecture. The transformation resonates with the ideals of Islamic finance driven by the Maqasid al-Shari’a. Figure 5.5(c) explains how the ideal objectives of Islamic finance development will also transform, provided Islamic finance architecture and infrastructure can align with the global transformative trends.

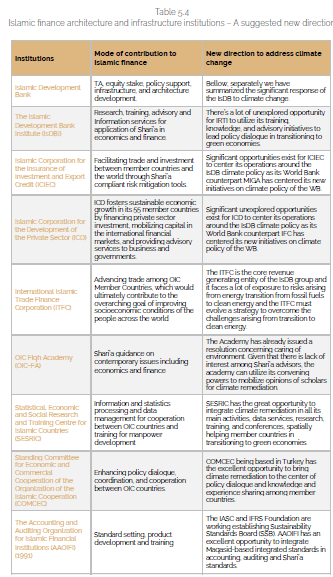

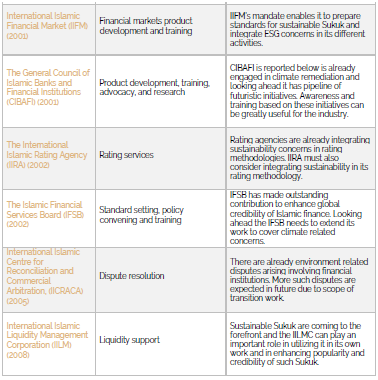

2. Islamic finance architecture and infrastructure institutions and global Apex Strategic Body

Table 5.4 lists the Islamic finance architecture and infrastructure institutions and offers a wish list about the new roles of these institutions to meet the challenges and opportunities of green economic transformation. In terms of thematic coverage, the institutional format is indeed comprehensive. However, we find two critical gaps in this current institutional framework. First, being a vital sector, Awqaf-driven social finance has no representation. Ideally, the International Awqaf Board (IAB) should reinvigorate this sector and integrate it into the financial sector policies. Second, the existing institutions do not have a culture of dialogue and a framework to present a common global strategy. Functional coordination between relevant institutions is an essential pillar of financial architecture. Therefore, there are significant opportunities for coordination between the institutions under the umbrella of a new Apex Global Islamic Board, addressing the challenges and opportunities of the GET.

There are significant opportunities for coordination between the institutions under the umbrella of a new Apex Global Islamic Board, addressing the challenges and opportunities of the GET

Observations on Islamic Finance Awareness to Climate Remediation

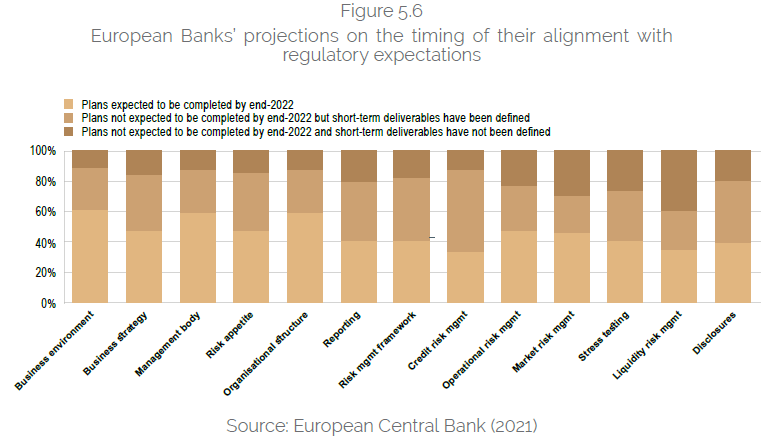

Active response of regulators is a new phenomenon emerging almost abruptly and very fast. The European Union has undertaken the most proactive policy initiative through the European Green Deal and European Taxonomy for financial regulation making sustainability disclosures mandatory for financial services businesses. Given the reactiveness of regulators, Figure 5.6 shows that even half of the European banks are struggling to meet regulatory expectations.

With a few exceptions, the regulators in the Islamic finance jurisdictions have mostly not yet responded to the climate challenge. Therefore, Islamic finance’s response to climate change is also slow. Nevertheless, in the following, we summarize some relevant points and some progress already made.

1. Islamic economics and finance response to climate change

- The Islamic financial contracts are generally carbon-neutral because a contract does not need to contain any condition about it not being used for certain specific purposes. However, it is understood that if the use of the contract is not for a Shari’a-compliant purpose, like, for example, musharaka being used to raise capital for an interest-based business, such utilization does not impact the validity of the musharaka contract. Therefore, a Shari’a-compliant financial contract can be utilized to finance a green or brown asset equally. Therefore, not financing a brown asset or encouraging the financing of green businesses is a regulatory and legal concern. This understanding and consideration also drive the Shari’a governance practices, and Shari’a supervisors absolve themselves from the responsibility of using the contracts they approve as Shari’a-compliant. However, perhaps it is an essential issue of Shari’a auditing to restrict the financing of carbon-intensive businesses by Islamic banks, which is also not the current norm.

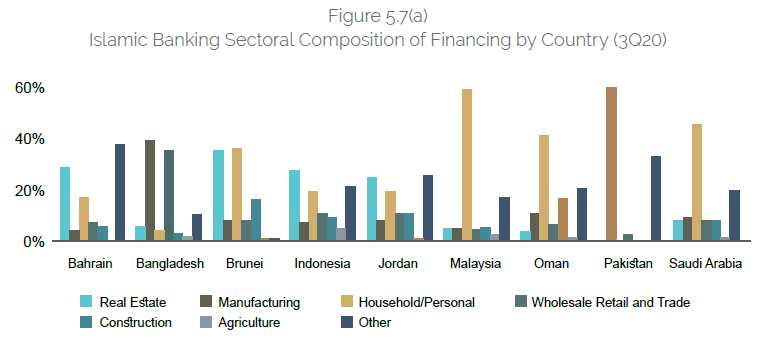

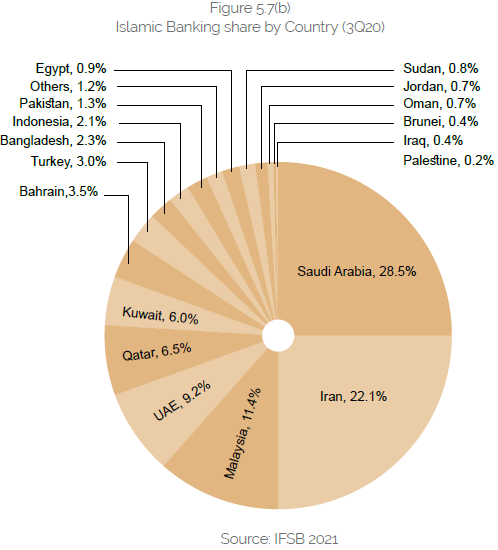

- Considering the point raised above, Islamic financial services as expected to be as carbon-intensive as conventional financial services. Figure 5.7(a) shows the sectors that Islamic banks finance. The current business practices in all these areas are known to be high carbon-intensive. Construction – cement, iron highest carbon-intensive sectors, vehicles and transport, industry, etc., are all carbon-intensive. However, unless pertinent data is available and appropriate disclosures are made, it is not easy to make any conclusions.

- Figure 5.7(b) shows shares of countries in global Islamic banking assets. Predominantly, Islamic banking originates from countries that are carbon-intensive economies. Therefore, it is evident that operating in a high-carbon home environment and banks cannot be expected to have a lower carbon footprint. Nevertheless, Islamic banks in Malaysia practice value-based intermediation, which aims to provide a low-carbon business environment. In addition, some Islamic banks voluntarily undertake initiatives to offset their carbon footprint. For example, Islamic Bank Bangladesh Limited, Meezan Bank Pakistan, and Al Baraka Banking Group Bahrain disclose their green financing initiatives.

- All the standards of both AAOIFI and IFSB are carbon neutral as these are adapted from IFRS and BCBS, respectively. We observed above that the IFRS Foundation is on its way to establishing SSB, and BCBS supervision has undertaken research that likely leads to incorporate climate concerns in relevant standards. These changes may also encourage AAOIFI and IFSB to revise their respective standards.

- The Islamic banks, Takaful companies, and fund managers in other jurisdictions can benefit from the Malaysian VBI and other initiatives (see below) or the Indonesian mandatory sustainability reporting and green finance initiative. These institutions, alternatively, also have the option to signup to the UN Principles of Responsible Banking (PRBs), Principles of Sustainable Insurance (PSIs), and Principles of Responsible Investment (PRIs). However, right now, very few Islamic financial institutions have signed up to these UN-initiated principles.

- The IsDB has already made pioneering and significant progress in mainstreaming sustainability sukuk. Other corporate, sovereign, and municipal sukuk can learn from this experience to enhance the effectiveness of sustainable finance.

- The significance of Islamic social finance has been emphasized, especially during the pandemic. Some initiatives originating from Indonesia and Malaysia are focusing on integrating climate and environmental sustainability concerns in awqaf. In addition, some academic conferences, webinars, and academic publications focus on establishing waqf-driven green transformation initiatives.

- “Saudi Arabia’s sovereign wealth fund has asked banks to help it develop an environmental, social and governance (ESG) framework, four sources said, a move that could allow it to expand its funding base to attract ESG-focused investors” Dubai, July 12 (Reuters). Central bank’s reserves, sovereign funds, and pension funds will indeed take essential lessons from this significant move, and in the coming years, huge funds could migrate to sustainable finance.

- Academic programs, intellectual activities, and awareness about sustainable finance are on the rise, and different programs include new content to curriculum and numerous webinars that address the theme of Islamic finance and sustainable development.

- A growing emphasis on adding sustainability for the new technology is driven initiatives such as FinTech using blockchain and the broader distributive ledger technologies.

Some PhD research addresses the impact of breakthrough technologies on energy transition and the role of Islamic finance in the transformation.

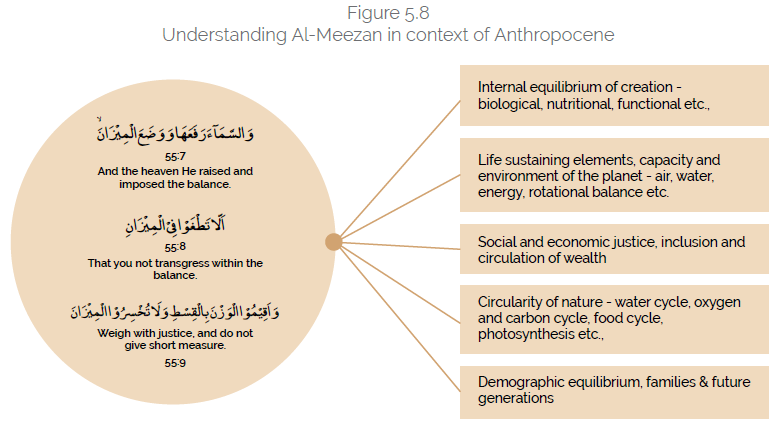

Inherently, Islamic economics and finance are guided by the worldview of a balanced (Wasatiyya) lifestyle, strong abhorrence to israf (waste), tabzir (extravagances and indulgences), riba (commercialization of lending and its financialisation), etc. It calls for al-Meezan (universal balance), stewardship (responsibility of human beings as a trustee of Allah on earth), and Maqasid al-Shari’a-based legislation and practices of life, including financial transactions. If these core principles were applied, in practice, the Anthropogenic should not have been caused.

However, the emergence of the Anthropocene (manmade climate disaster) is a recent scientific phenomenon. New data has validated that pilling waste and CO2 emissions from industry and transport impact the earth’s resources. Because it is a new phenomenon so, Islamic economics and finance have not recognized climate crises significantly. For example, since the publication of Chapra (2006), there has been a tremendous increase in the literature on Maqasid al-Shari’a and its implications for development and Islamic finance. All these studies use a static framework of five elements of the Maqasid al-Shari’a – religion, life, lineage, intellect, and wealth. The Maqasid al-Shari’a are perspectives-based guideposts for legislation, policy formulation, and strategic management frameworks like the balanced scorecards.

The five elements framework of the Maqasid fails to address remediation of the Anthropocene appropriately. To fill the gap, we suggest a Maqasid framework with seven perspectives –adding a) trust and responsibility and b) remediation of climate crises and healing ecology and environment. Trust and responsibility are derived from the status of human beings as trustees of Allah on earth. A trustee must behave and act with the highest level of responsibility, in line with the principals. In addressing any challenge, we revert to the source of guidance. Therefore, healing ecology, an unprecedented universal need, is derived from Al-Meezan (the universal balance). In Figure 5.8, we elaborate on the concept of Al-Meezan in the context of the Anthropocene.

2. The cost of GET and SDG17

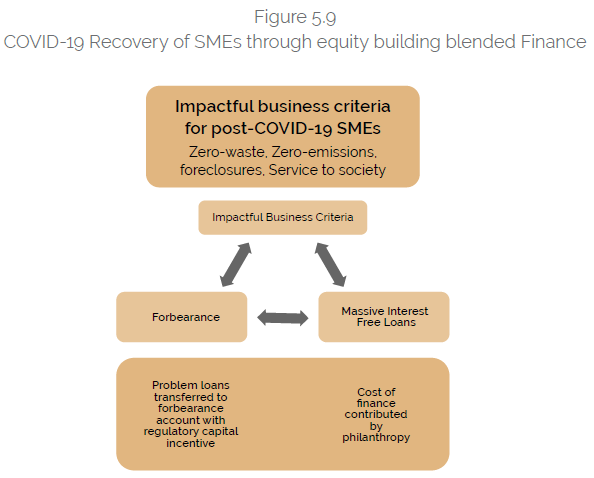

GET will require achieving (net) zero-emissions, near zero-waste, building equity base of green businesses, controlling financialisation, requiring businesses to disclose on these and other sustainability criteria set by governments and regulators, cleaning up rivers, seas, and oceans, restoring ecosystems, investing in breakthrough green technologies, greening buildings, and residences, etc. GET, therefore, initially faces additional costs termed as “green premiums”; some estimates show these to be 10 to 16% over and above the cost of business as usual. However, with the pace of technologies and innovations, these costs can be expected to be drastically reduced. Moreover, considering the inter-generational comparison of costs of business as usual and green transformation, the additional costs must be met by financial innovation.

SDG17 – coordination and cooperation for the SDGs – provide a framework for blended finance to generate additional low-cost resources for financing the GET. Blended finance is not a new idea, it has previously been used by the IsDB to finance polio vaccines for Pakistan based on Murabaha, and the cost of financing was contributed by the Bill & Melinda Gates Foundation as a grant, and other international organizations also participated in the 400 million dollars financing with different types of contributions. Because of the blending of commercial and philanthropic finance, the funds were provided to the beneficiary as cost-free. The local scholars’ services were mobilized to encourage vaccination against polio. In another sukuk idea, namely One-Wash Sukuk for sanitation, the same concept of blended.

3. Response of selected institutions to climate change

a) Bank Negara Malaysia (BNM)

Malaysia is leading in establishing a robust climate policy landscape within the Islamic finance jurisdiction areas. The BNM – Bank Negara Malaysia (2018) introduced the Maqasid-driven climate-friendly (people, planet, profit) framework for Islamic banks known as Value-Based Intermediation (VBI), and 14 banks are actively using the framework in their businesses processes and reporting. The framework has also been extended to Takaful and other business segments. In 2021 Malaysia also introduced the “Climate Change and Principle-based Taxonomy,” a comprehensive long-term strategic framework to integrate climate targets in financial services and other businesses and requiring disclosures accordingly. The BNM and Securities Commission Malaysia jointly monitor the implementation of the framework. In June 2021, the Joint Committee on Climate Change (JC3), an initiative co-chaired by Securities Commission Malaysia and Bank Negara Malaysia, organized the flagship conference Finance for Change which was attended by over 4,000 international participants.

b) Financial Services Authority (Otoritas Jasa Keuangan) OJK Indonesia

In 2017 the OJK introduced Sustainable Finance Umbrella Policy. Sustainability reporting was made mandatory for financial institutions by the OJK in 2019. In 2021, the OJK issued Sustainable Finance Roadmap Phase II as a strategic framework for financial institutions to facilitate the national targets of reducing emissions per the Paris Agreement commitments. The framework applies to the entire financial services sector, including Islamic financial institutions and financial markets.

c) The Islamic Development Bank Group

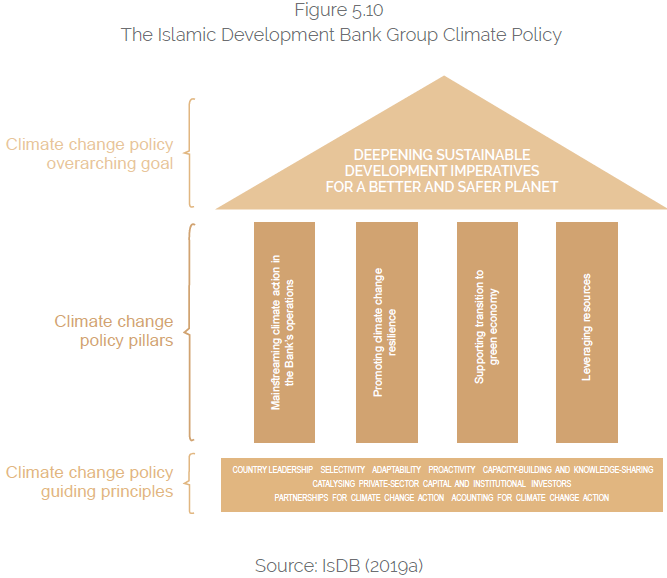

Since 2017, the IsDB group has produced several documents addressing different aspects of the Paris Climate Agreement to align with the bank’s operations and helping member countries to follow suit. The climate policy document and the strategic climate framework translate the outcomes and recommendations of the various studies in terms of implementable gaols and policy guidance framework. Figure 5.10 summarizes and integrates the core points of the two documents. There are three significant and visible impacts of this climate policy and strategy. First, the IsDB has made pioneering efforts and significant achievements in issuing thematic sustainable sukuk and strengthening the SDG17 in the blended finance framework for eradicating disease, improving water, sanitation, and housing at affordable financing rates.

These innovative examples of financing are replicable by the sukuk industry and the overall international development finance. Second, the climate policy and strategy are expected to be translated as a guiding framework for the operations of all members of the IsDB group – ICIEC, ICD, ITFC, and IsDBI. However, this process has been slow and needs to be expedited. Third, the IsDB has organized impactful events to publicize the sustainability agenda and develop collaborative and innovative programs to address the challenges. Fourth, the focus of vital programs like scholarship has been changed to address the challenge of climate change. The IsDB climate initiatives can be used for dialogue among member countries, especially the Islamic financial services (banking, insurance, sukuk, equities) and architectural and infrastructural institutions (AAOIFI, IFSB, IIFM, etc.). The IsDB already has strategic instruments for such purposes which need to be reviewed and updated. Examples of the documents are:

- 10-year framework and strategies for development of Islamic financial services industry; • Islamic micro-finance development – strategies and initiatives; and

- financial sector assessment template for Islamic finance.

These industry collaborative documents were introduced as parts of the IsDB reform and can be reinvigorated to meet new challenges and opportunities (see Table 5.3 for IsDB group contribution to Islamic finance development.

It is worth noting that during the 2020 the G20 Presidency was with Saudi Arabia and the IsDB President led the MDBs Working Group. In addition to Saudi Arabia, two other members of the IsDB, namely, Turkey and Indonesia were also in the G20. Regarding the impact on the global policy landscape, the G20 is the most important international platform for development cooperation. The G7 policies are the essential movers of the G20 policies. One crucial focus area for reform by the G20 is the multilateral development banks (MDBs). On August 16, the Treasury of USA issued “Fossil Fuel Energy Guidance for Multilateral Development Banks” concerning limiting the MDBs exposures to the fossil fuel sector. This guidance through the G20 will reach all MDBs, including the IsDB. The guidance note is expected to expedite energy transition by encouraging financing of specific activities and discouraging certain other activities. Regarding its business sustainability, where the ITCF generates the bulk of revenues by financing fossil fuels in the rapidly changing environment, the IsDB needs further strengthening of its climate remediation initiatives and activities and revenue sustainability from non-fossil activities.

d) The Islamic Financial Services Board (IFSB)

The IFSB is one of the most important architectural and infrastructural institutions of Islamic finance. It sets standards, convenes meetings and forums of critical stakeholders, undertakes research, and offers capacity-building events. It publishes the flagship annual “Islamic Finance Stability Reports” (IFSRs). The IFSRs are useful reports about Islamic finance, highlighting achievements, assessing the current state, and challenges and opportunities. The IFSR 2021, as well as previous reports, do not mention climate change. Neither any other research event convened by the IFSB mentions the climate challenge. Given the importance the BIS and BCBS, IMF, central banks, and other institutions give to climate change, we consider the IFSB should also have timely involvement in this critical dialogue.

- Using its convening mandate and capacity, the IFSB can effectively raise awareness among its stakeholders about climate change, emerging global policy landscape, and economic and financial transformations taking a fast pace and the strategic business risk for Islamic finance.

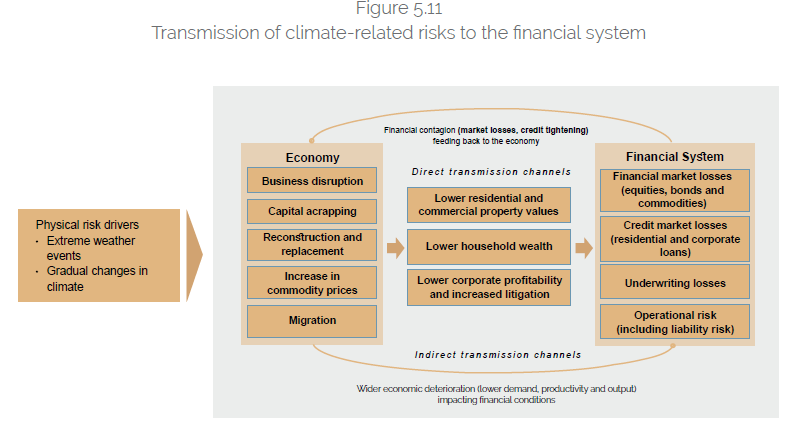

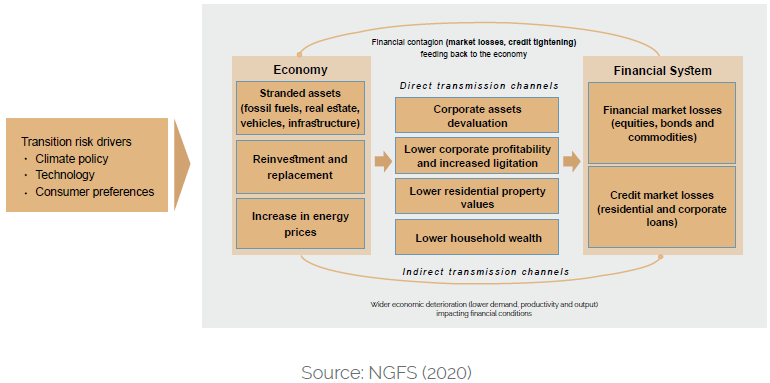

- Significant research has identified climate-related financial risks, especially in the BIS Green Swan thematic work and the NGFS framework (see Figure 5.11). The two risks identified are physical risks of climate events and transition risks induced by climate policies. The BCBS research tries to relate the credit, market, operational, and liquidity risks exposure to these risks. These new risk identification and mitigation directions are relevant for Islamic finance, and the IFSB-1 Principles of Risk Management in Institutions Offering Islamic Financial Services need to be revisited.

- Any factors that impact the risk management standards of IFSB will also impact capital adequacy standards, disclosure and transparency standards, and core principles of Islamic banking regulation and supervisory guidelines. The implication is that the overall timely review of the standards is the need of the hour. It will be time and resource-consuming. Now that the BNM has hosted the IFSB and introduced the VBI strategy for Islamic banks and Takaful and other businesses have also issued “Climate Change and Principle-based Taxonomy,” a good starting point could be convening events to discuss progress in these initiatives for knowledge sharing.

Apart from standard-setting, the IFSB has beneficial initiatives concerning prudential data for Islamic financial services. Climate-related data is scarce, and early incorporation of climate-related data in the prudential data will be of high value for industry researchers.

Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)

Apart from accounting standards and auditing standards, AAOIFI’s Shari’a standards of Islamic financial contracts have been of high value for all those who want to practice Islamic finance and those who want to learn Islamic finance. The establishment of AAOIFI was necessitated to enhance transparency in Islamic instruments’ financial reporting, adapting the templates of (International Financial Reporting Standards) IFRS.

The IFRS is transforming, and they recently announced that “The Trustees of the IFRS Foundation today announced the formation of a working group to accelerate convergence in global sustainability reporting standards focused on enterprise value and to undertake technical preparation for a potential international sustainability reporting standards board under the governance of the IFRS Foundation”. The means that the IFRS is moving towards the Sustainability Standards Board (SSB), a reporting template that is more integrated like the Global Reporting Initiative Global Sustainability Standards Board (GSSB) to conform to the industry needs for sustainability reporting.

Ideally, AAOIFI should have developed an integrated reporting framework using a Maqasidbased multidimensional but integrated template. However, in retrospect, we can say that such an innovative approach was not possible for the infant industry. However, given the current consensus on an integrated reporting template and even the IFRS moving towards that, AAOIFI must change its reporting template from the current narrow IFRS structure to a broader Maqasid structure for accounting and auditing standards.

As far the Islamic financial contracts are concerned, all the original contracts like mudharaba, musharaka, and salam and all the new structured contracts like murabaha, istisna’, ijarah ending in ownership, commodity murabaha and sukuk, etc., are essentially carbon neutral. That means the contract can be used to finance green assets (electric vehicles) or brown assets (fossil fuel vehicles). However, some contracts can be designed to be used for green financing assets like green loans and a green line of credits. This type of discussion is relevant for financial institutions as explained in recent NGFS “A Status Report on Financial Institutions’ Experiences from working with green, non-green and brown financial assets and a potential risk differential”. However, from Islamic finance perspectives form now such discussions are relevant only from academic perspectives. Despite that, should there be any sustainability and ESG awareness concern for AAOIFI and Shari’a supervisors remains a highly relevant question if the industry must respond positively and effectively to the challenge of climate change? The question is especially pertinent as Shari’a’s screening of investments at this stage ignores ESG considerations.

f ) International Islamic Financial Markets (IIFM)

The IIFM mandate covers both money market and capital market instruments, primarily sukuk and equity market instruments. The IIFM has produced several documents for liquidity and risk management instruments and is producing an annual report on sukuk; the 10th-anniversary report was launched in a webinar on 4th August 2021. Sustainability and ESG issues, and climate concerns have not attracted any standards and documents issued by the IIFM. However, the 4th of August webinar also addressed the themes of the ESG issues and sustainability sukuk. It is expected that the IIFM may establish an ESG working group, and the working group will organize certain events.

Good forward, an essential initiative for the IIFM will be to create consensus on the criteria and standards for sustainability sukuk and integrating ESG concerns in existing Shari’a screening as these two areas fall under the IIFM mandate.

g) General Council of Islamic Banks and Financial Institutions (CIBAFI)

CIBAGI is an advocacy think tank for Islamic finance. With regards to climate change response, CIBAFI is one of the most active institutions of Islamic finance as indicated by the following as reported in its Annual Report 2020:

- CIBAFI Issues regular briefings, and the 13th briefing covers “Climate Change and its Implications for the Financial Industry.” It undertook a climate risk perception study which was participated by 101 Islamic banks from 35 jurisdictions. Around 33% consider climate risk “fairly important,” and almost 39% consider it to be either essential.

- CIBAFI has established a well-represented Sustainability Working Group which has held three meetings so far. The SWG will initially focus on two projects, (1) a Sustainability Guide for the Islamic banking industry and (2) Carbon Footprint Measurement Methodology for Islamic financial institutions.

- CIBAFI Secretariat, jointly with BAB, has successfully conducted a webinar with the theme, “Sustainability within the Financial Sector: Practices, Trends and Achievements,” on 28th October 2020.

- On 24th December 2020, CIBAFI submitted its comments to the International Financial Reporting Standards (IFRS) Foundation on its Consultation Paper on Sustainability Reporting.

Going forward, one can expect CIBAFI to utilize its convening power to organize awareness and capacity-building events about Islamic finance’s response to climate change.

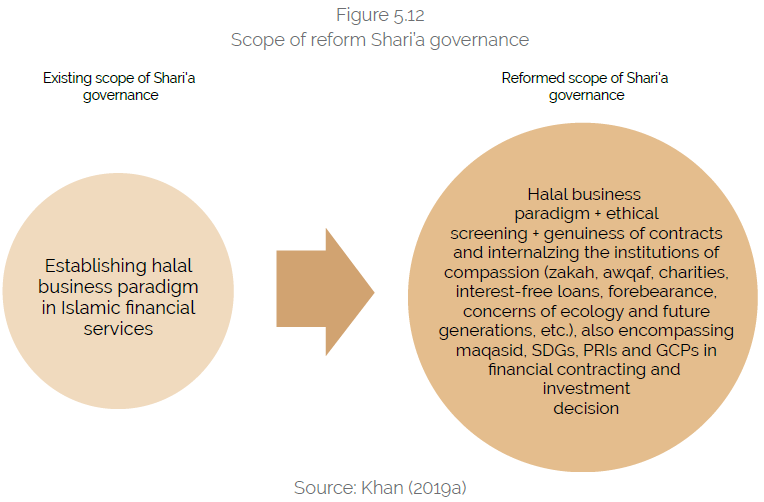

h) Shari’a governance

Shari’a governance is an essential building block of the Islamic finance architecture and infrastructure. However, it is not represented by any designated institution. The OIC Fiqh Academy, national centralized Shari’a boards, IsDB Shari’a board, and AAOIFI Shari’a boards are important boards to constitute the institutional framework of the overall Shari’a governance. The overarching function of Shari’a governance has been to establish the permissibility of contracts and transactions in the narrative of Halal finance. We have argued that Halal, though it is essential, is insufficient in the identified race to responsibility. Shari’a scholars and boards, therefore, have not yet positively responded to the urging need for climate remediation. The Shari’a scholars must respond to climate remediation, and in that case, the scope of Shari’a governance will be significantly expanded, as pictured in Figure 5.12.

Conclusions and Recommendations

In this chapter, we have highlighted the newly emerging perception that Anthropogenic (manmade global warming) has increased climate risks to the top of all risks facing the global economy, the earth, and species. What is more important to note is that the traditional risks directly linked to economic conditions have also aggravated simultaneously, but due to the gravity of the climate risk, those risks remain dormant in our perceptions. We also presented published and credible data about the divergence between the human development index (HDI) and ecological footprint (EF). Developed and emerging countries have achieved high HDI but at the cost of damaging the environment and ecology. On the other hand, the least developed countries have made insufficient progress in HDI therefore they have hardly contributed in destroying the ecological system. In achieving the UN Sustainable Development Goals (SDGs), realizing and creating an alignment between HDI and EF is imperative. Five years of the SDGs timeline has already passed, the remaining 10-years of the SDGs timeline are declared by the UN as the Ecosystems Restoration Decade. It implies that SDGs cannot be achieved without healing and restoring ecology. This requires a new paradigm that can ensure the healing of ecology through the economy so that green economic transformation (GET) can be achieved.

We argued that the ideal target of the GET is the achievement of the highest HDI within the ecological capacity of one earth. Therefore, the developed countries must drastically reduce their ecological footprint to the safe limit of one earth, and to do so without an adverse impact on their HDI requires unprecedented governmental and business involvement. Numerous initiatives in that direction are already being implemented over the last two years. The international financial architecture is transforming, and the national financial infrastructures are undergoing drastic changes focusing on the role of financial services and businesses in talking about global warming and achieving the targets of the Paris Agreement.

The original inspiration of Islamic economics and finance is its focus on responsibility. In practice, however, Islamic finance has been operating within the existing legal and regulatory environment, changing a race towards responsibility. If Islamic finance delays its positive response to these changes, it risks losing its credibility and market share. Hence fast and positive response is the need of the hour for local and global strategic repositioning. In this regard, we reviewed the role of the Islamic finance architecture and infrastructure institutions, and we found the following.

- Islamic finance is a small integral segment of global financial architecture and cannot flourish as a standalone business segment. The changes globally happening need a fast and concerted response from Islamic finance stakeholders.

- IFSB and AAOIFI, the most important institutions of Islamic finance architecture and infrastructure, have yet to respond to the changes that fall in the areas of their respective mandates. For IFSB, these areas are climate-related risks and governance disclosures, and for AAOIFI, these areas are integrated reporting and disclosures.

- Some leading national institutions like BNM and OJK have undertaken wide-ranging national strategic initiatives to address climate-related commitments. Other countries can benefit from these experiences.

- The IsDB Group has implemented important initiatives in the framework of climate policy and SDGs response. However, energy transition also poses challenges to the IsDB group, making it urgent for the group to diversify its revenue sources. The IsDB Scholarship Program’s new focus on climate change exemplifies several initiatives in the right direction. The GET is an opportunity for the group entities to increase their training and advisory services to member countries on different aspects of the green transition. This will require updating strategic documents such as IsDB (2019), IsDB-IFSB (2007), IRTI (2008, 2010), for example. Updating these documents will facilitate dialogue on the transition of member countries to green economies and the vital role of Islamic economics and finance.

- There is a comprehensive list of institutions that support the architecture and infrastructure of Islamic finance. However, there is no institutional representation of Islamic social finance segments like awqaf. Moreover, there is a great need for cooperation and coordination of the activities of these various institutions, realizing their respective new roles given the rapidly changing global climate policy landscape and the extensive disruptive opportunities that it will bring. Such cooperation is also needed under SDG17 to create blended finance opportunities for GET.

- Shari’a governance, educational programs, research, and product development are vital components of the financial infrastructure, and these areas of Islamic economics and finance also need resetting.